NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

What Insights Can DAOs Gain from the World of Partisan Politics?

DAI Stablecoin Achieves Over $5 Billion Market Cap Due to Increased Yield and Elevated Spark Protocol Influence

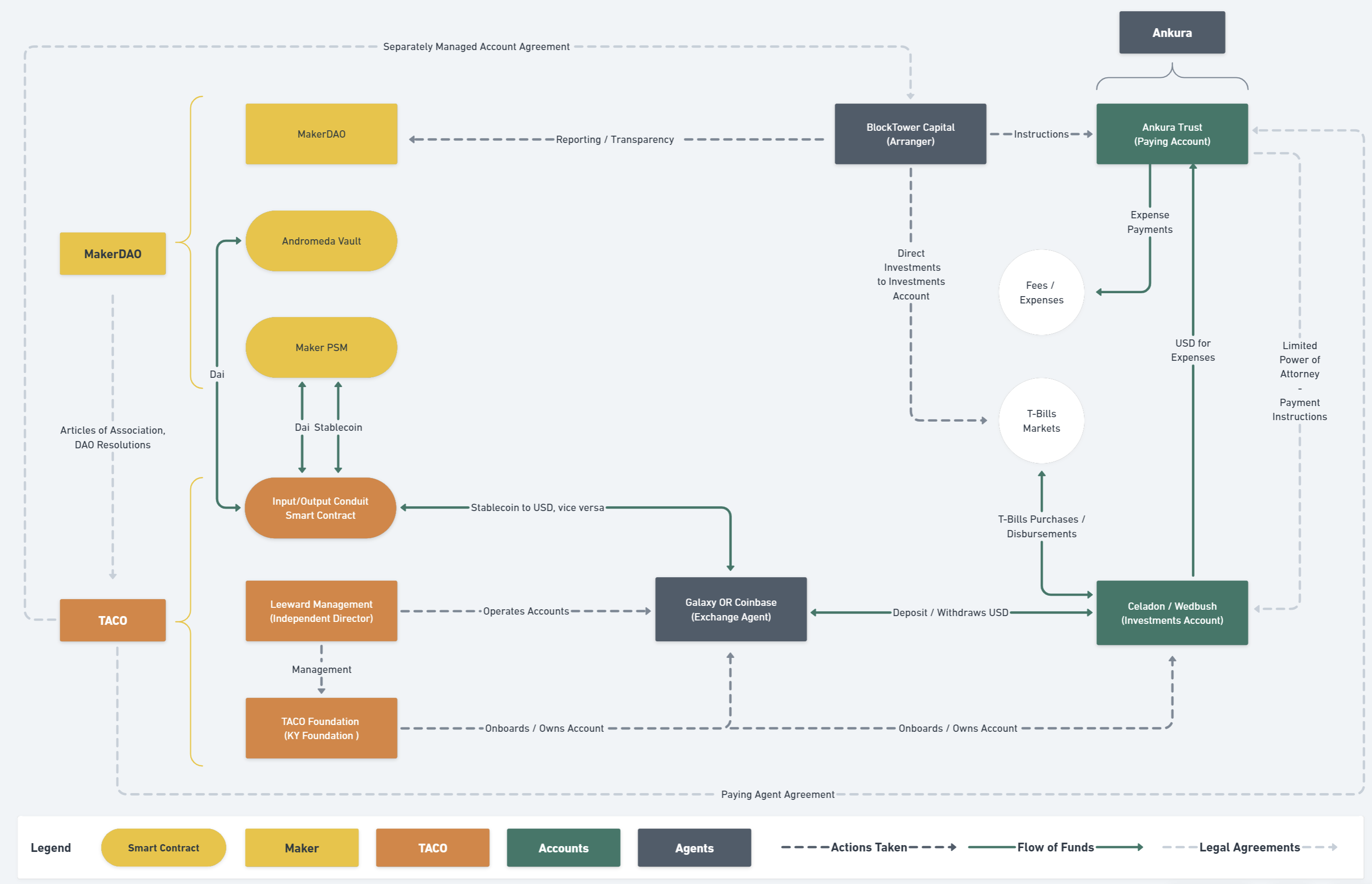

The MakerDAO community, the decentralized autonomous organization (DAO) responsible for the stablecoin DAI, has authorized the acquisition of up to an extra $1.28 billion worth of U.S. government bonds through the assistance of crypto asset manager BlockTower Capital.

In a unanimous vote held on Thursday, the voters expressed their overwhelming support for the establishment of a new real-world asset (RWA) vault called BlockTower Andromeda. As per the proposal, the vault will be exclusively focused on investing up to $1.28 billion in short-dated U.S. Treasury bonds, with funding provided by Maker's overcollateralized DAI stablecoin.

BlockTower will receive a 0.15% arranger fee from Maker, while Celadon Financial Group will serve as the broker, and Wedbush Securities will be responsible for asset custody.

The Maker project has successfully acquired government and corporate bonds worth $1.1 billion, utilizing a secure vault managed by Monetalis Clysdale, an asset manager. Additionally, Maker has provided loans to financial institutions like Huntingdon Valley Bank and Societe Generale-Forge, the crypto-focused subsidiary of the renowned French banking giant.

Structure of the new BlockTower RWA vault (MakerDAO)

The recent decision aligns with Maker's aspirations to expand the range of reserve assets supporting its $5 billion stablecoin, DAI, and enhance protocol revenues through investments in strategies that generate yield. Maker generates yield by storing $500 million worth of USDC at Coinbase Prime, while Gemini rewards Maker for holding Gemini Dollar (GUSD) as part of the reserve assets.

The platform's investment strategy further highlights the increasing desire among crypto native entities, like DAOs, to explore traditional financial instruments as a way to generate a stable yield on their treasury holdings.

BlockTower is currently overseeing several Maker vaults, with a collective investment of approximately $90 million in structured credit products on the Centrifuge blockchain-based credit protocol.