Bitcoin Languishes as ETF Optimism Subsides; PEPE Takes the Lead in Altcoin Profits

Donald Trump Possesses Crypto Holdings Valued Up to $500K

Coinbase Ventures' Strategic Investment Propels Rocket Pool Token to Soaring Heights

Crypto lending platform Celsius Network, which is currently facing challenges, is causing disruption in its ether (ETH) staking approach, exacerbating the already lengthy queue to activate fresh validators on the Ethereum network.

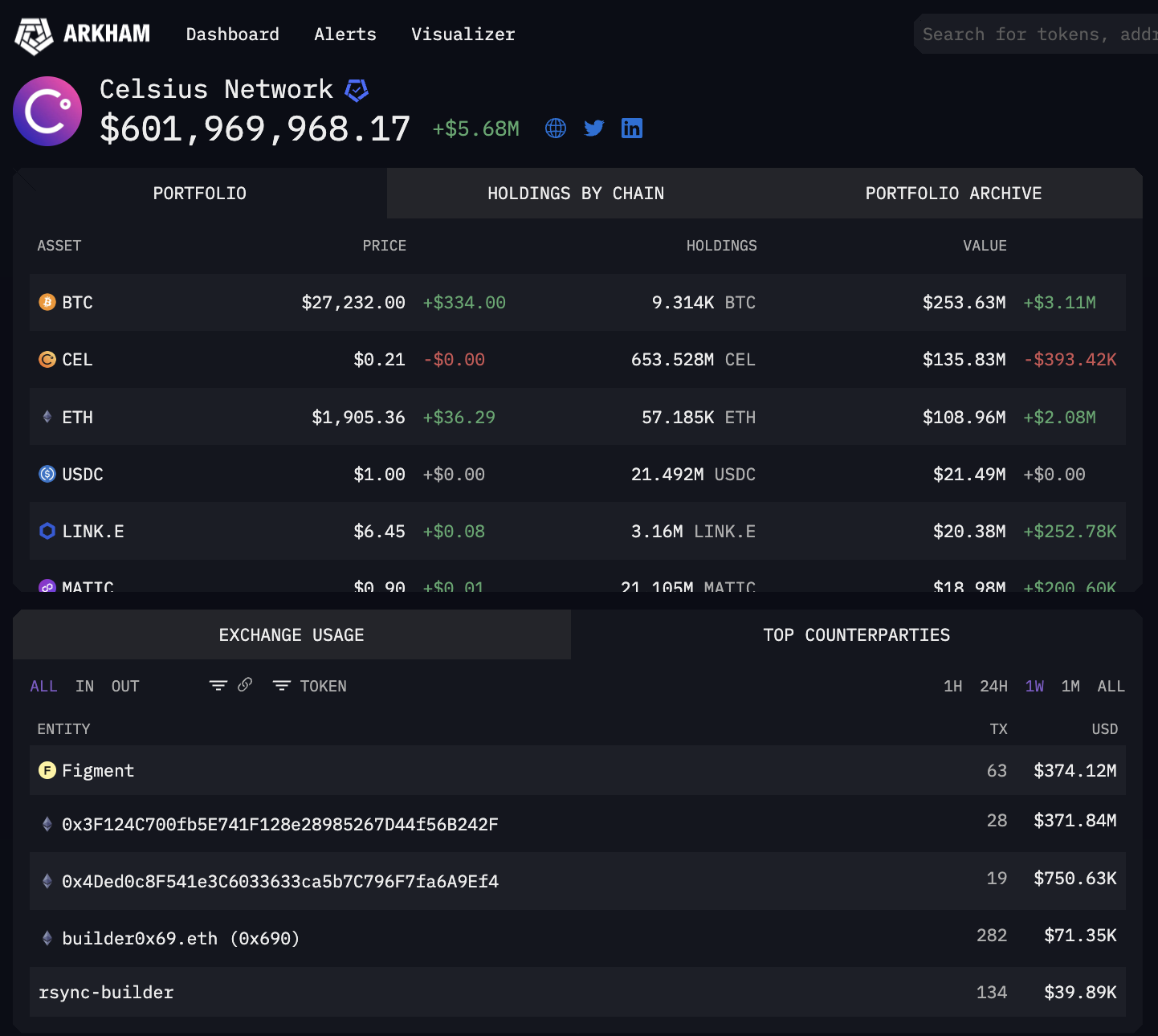

During a span of 48 hours, the company has been actively transferring ETH into staking contracts following the redemption of approximately $813 million worth of staked ETH from leading liquid staking provider, Lido Finance. According to data from Arkham Intelligence, Celsius has deposited around $745 million of ETH since June 1.

The addition of these transfers has further extended the already lengthy waiting period to set up new validators on the Ethereum network, now reaching a staggering 44 days. Tom Wan, an analyst at 21Shares, a crypto investment product manager, pointed out that Celsius may be accountable for an additional week of delay.

These transactions represent the most recent progress in the lender's efforts to reorganize its staked ETH reserves following the implementation of Ethereum's Shanghai upgrade in April, which allowed for withdrawals from staking contracts. At that time, Celsius had approximately 460,000 ETH, valued at $870 million today, staked with the liquid staking platform Lido Finance. Additionally, they had deployed around 160,000 tokens, equivalent to approximately $300 million at current prices, in their own staking pool.

The transfers took place as the company underwent a restructuring process following its bankruptcy filing in July. The bankruptcy was triggered by liquidity problems caused by a steep decline in cryptocurrency prices and a surge in user withdrawals. Recently, the U.S. bankruptcy court conducted an auction for the company, with Fahrenheit, an investment group supported by Arrington Capital, emerging as the successful bidder. Fahrenheit will now acquire the company's assets, which include its institutional loan portfolio, staked cryptocurrencies, and crypto mining units.

Celsius’ staking maneuvers

CoinCryptoUs reported that the lender took an innovative approach to revamp its staking allocations. In a strategic maneuver, they entrusted a significant portion of their available ETH stash, amounting to around $75 million, to the renowned institutional staking service Figment. Notably, Figment operates in a non-custodial capacity, providing a secure and reliable solution for staking.

Celsius promptly requested the withdrawal of its 460,000 staked ETH from Lido once the platform enabled such transactions. The company has already successfully retrieved 428,000 tokens, valued at $813 million. According to blockchain data, Celsius divided these assets into two distinct crypto addresses, which were previously utilized for staking with Figment and depositing into its own staking pool. However, there is still an outstanding balance of 32,000 ETH that Celsius is awaiting from Lido.

Based on a Dune Analytics chart by 21Shares, the firm transferred a combined amount of 291,000 ETH, valued at $553 million, into staking contracts on Thursday. Out of this total, 192,000 tokens were deposited into the Celsius staking pool, while Wan reported that 99,000 tokens were staked with Figment.

The company resumed transferring tokens into staking contracts on Friday, ensuring that it stays on schedule to stake the entire 428,000 ETH stash. According to Arkham data, as of now, the firm has successfully staked approximately $199 million worth of ETH through Figment and has also deposited around $12 million into the Celsius staking pool.

Following the transfers, Arkham reports that Celsius wallets still retained approximately $109 million worth of ETH.

Ethereum stakers wait

Staking enables the troubled lender to generate rewards from their digital asset holdings during the period when user deposit withdrawals are restricted.

Nevertheless, it exacerbates the strain on an already congested queue for adding new validators to the Ethereum network. Validators are participants in a proof-of-stake blockchain who stake tokens to secure the network and validate transactions in return for incentives.

The demand for staking has experienced a significant surge following the activation of the Shanghai upgrade on April 12. According to data from blockchain intelligence firm Nansen, deposits have exceeded withdrawals by nearly $5.5 billion, resulting in new participants facing a waiting period of approximately one month to establish validators.

Celsius' recent staking deposits have significantly lengthened the waiting list. According to the Ethereum tracking website Wenmerge, the projected duration to clear the queue has now extended to 44 days and one hour.

On Thursday, Wan predicted that if Celsius dedicates all 428,000 tokens to staking, it would result in an additional six days and 15 hours being added to the waiting period. This would subsequently increase the total waiting time to 45 days.

“Staking activation queue up only,” pseudonymous blockchain sleuth Alto, who was first to report Celsius’ transfer to staking wallets, tweeted.