Crypto Global Bid and Ask Metric Plunges 20% Over Weekend, Indicating Extremely Low Liquidity Levels

Robinhood's Crypto Trading Volume Plummets by 68% in May, Reaching $2.1 Billion

Robinhood Ceases Trading Support for All Tokens Listed in SEC Lawsuit as Securities

While bitcoin and ether were largely stagnant during the week, a handful of lesser-known decentralized finance (DeFi) tokens emerged with impressive double-digit gains.

Injective Protocol (INJ) emerged as the top performer in the DeFi space this week and overall. As a layer 1 blockchain specifically designed for decentralized finance applications like exchanges and lending protocols, INJ has demonstrated impressive growth, leading the pack year to date with a remarkable 527% increase since January.

Lido (LDO), Synapse (SYN), and PancakeSwap (CAKE), prominent DeFi protocols, also experienced notable gains during the week, with their prices rising by 15%, 13%, and 12% respectively.

ARPA Chain (ARPA), a digital asset in the Computing industry, experienced the largest decline of the week, dropping by a significant 40%. The CMI (Crypto Market Index) comprises a total of 156 assets spanning six sectors, with each asset categorized based on its specific purpose or application.

In a volatile week marked by various factors such as the U.S. Congress passing a bill to increase the debt limit, concerns over inflation, and the growing possibility of another interest rate hike by the Federal Reserve, Bitcoin and ether experienced modest gains. Bitcoin secured the 46th position with a mere 1.39% increase, while ether claimed the 67th spot, rising by 3.5%. The week concluded with an unexpectedly strong employment market report on Friday, revealing the addition of 339,000 jobs to the U.S. economy in May, surpassing the anticipated 190,000. This robust data seemed to reinforce the argument for maintaining a hawkish monetary policy stance. Traditionally, tight job markets indicative of a robust economy tend to intensify inflationary pressures.

However, there were additional indications that were not as clear-cut. Despite expectations of a 3.5% unemployment rate, the actual rate rose to 3.7%, suggesting a slight increase. Furthermore, the U-6 unemployment rate, which provides a more comprehensive assessment of the labor market by accounting for discouraged and underemployed workers, also experienced an increase.

At present, the Bitcoin Trend Indicator (BTI) is indicating a downward trend, which represents a decline compared to the previous neutral signal. On the other hand, the Ether Trend Indicator (ETI) remains steadfast in signaling that the asset is currently experiencing a "significant uptrend" in its value.

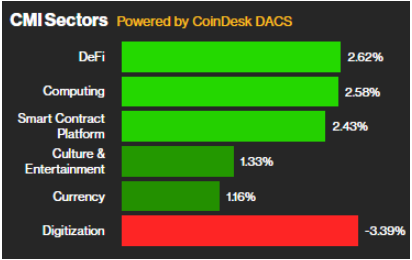

Out of the five sectors in the CoinDesk Market Index (CMI), DeFi emerged as the frontrunner in the past seven days, achieving an overall gain of 2.57%. Conversely, the Digitization sector experienced the lowest performance, declining by 3.4% over the same time period.

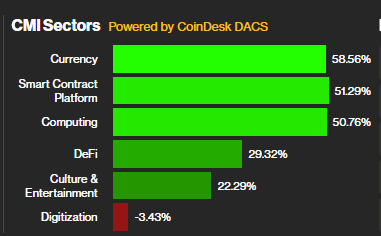

In terms of year-to-date performance, the DeFi sector currently holds the fourth position among all CMI sectors, with the Currency sector taking the lead. Meanwhile, Digitization, the smallest sector within CMI, is experiencing slower growth compared to others.

Source Coindesk