Bitcoin Decline Sparks Trader Concerns as USDT Faces Selling Pressure on Curve and Uniswap

Crypto Global Bid and Ask Metric Plunges 20% Over Weekend, Indicating Extremely Low Liquidity Levels

Robinhood's Crypto Trading Volume Plummets by 68% in May, Reaching $2.1 Billion

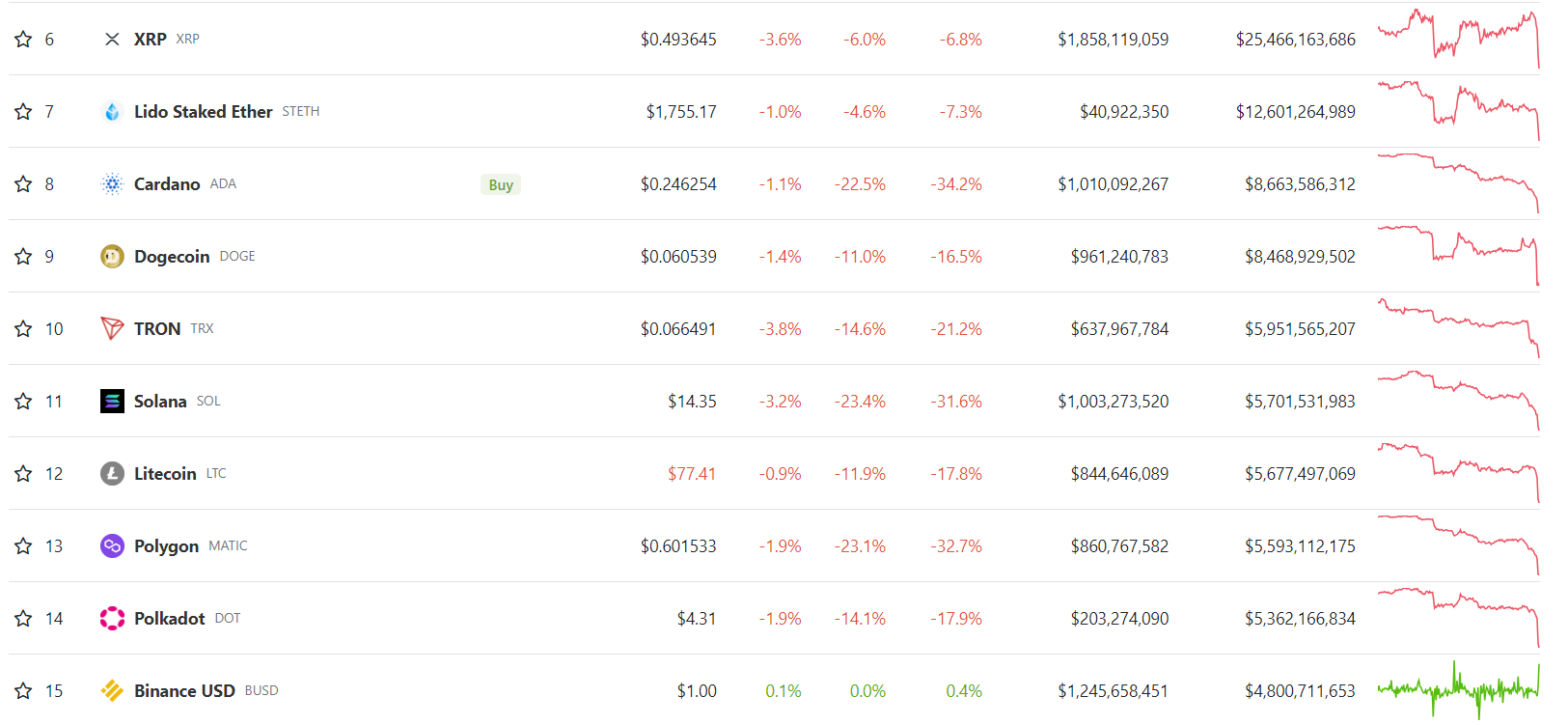

In the past 24 hours, the tokens of leading blockchain networks experienced a significant decline of over 20%. This downturn occurred in response to a presumed risk-averse market sentiment following a recent event where 13 tokens were accused of being securities in a lawsuit filed by the U.S. Securities and Exchange Commission (SEC) against cryptocurrency exchanges Binance and Coinbase.

Data reveals that the bulk of these losses occurred during the early hours of Saturday. Within a matter of hours, Solana (SOL), Polygon (MATIC), and Cardano (ADA) plummeted by as much as 25%. This sharp decline prompted speculation on Crypto Twitter, with some speculating that a major crypto fund had offloaded their holdings amidst the less liquid market conditions.

The data reveals that these tokens were subjected to substantial weekly declines, reaching as high as 34%, as a result of these maneuvers.

Tokens fell as much as 25% in the past 24 hours. (CoinGecko)

Consequently, prominent cryptocurrencies like BNB (Binance Coin), DOGE (Dogecoin), and XRP (Ripple) experienced a significant decline of more than 11%. Bitcoin (BTC) witnessed a decrease of 3.6%, whereas ether (ETH) registered a slide of 4.5%.

Coinglass data reveals that in the early hours of Saturday, the crypto-tracked futures market experienced an extraordinary wave of liquidations, totaling nearly $300 million. This staggering amount surpassed the previously established nine-month record for liquidations, set just earlier this week.

Crypto liquidation is the act of forcibly terminating a trader's positions in the cryptocurrency market. This happens when a trader's margin account becomes incapable of sustaining their active positions due to substantial losses or inadequate margin to fulfill the maintenance criteria.

In the recent past, the Securities and Exchange Commission (SEC) designated tokens associated with foundations, companies, or protocols such as Polygon (MATIC), Sandbox (SAND), Filecoin (FIL), Axie Infinity (AXS), Chiliz (CHZ), Flow (FLOW), Internet Computer (ICP), Near (NEAR), Voyager (VGX), Dash (DASH), and Nexo (NEXO) as securities.

The regulatory filings have prompted significant retail trading platforms like Robinhood to cease their support for tokens ADA, SOL, and MATIC, marking a notable alteration in their trading avenues.