NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

- The performance of BTC and ETH following the FOMC decision has been underwhelming, in stark contrast to the reaction observed in traditional finance.

- Both BTC and ETH have recently broken below the lower range of their Bollinger Bands, entering technically oversold territory.

Bitcoin and ether plunged into oversold territory on Thursday, triggered by the hawkish remarks made by Jerome Powell, the Chairman of the U.S. Federal Reserve. This came after the central bank put a halt to its 14-month cycle of raising interest rates.

The level of hawkishness can be subject to interpretation, but here is what we are aware of:

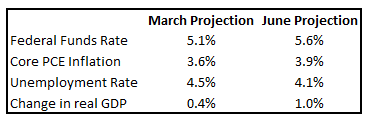

The decision to halt the increase in interest rates and maintain the target rate of 5.0-5.25% was widely anticipated and probably already factored into the market. The FOMC's March projections brought about the subsequent modifications.

The upward revisions in Core PCE inflation and the Federal Funds rate projections are particularly concerning.

Despite recent data showing progress, the market's response suggests that inflation continues to be a significant concern. Chairman Powell reinforced this view in his comments on Wednesday, emphasizing the need for future monetary tightening while acknowledging the existence of economic "lags" as a reason for the current pause.

The analogy can be likened to a driver slightly easing off the accelerator when navigating sharp turns, without any intention of applying the brakes or altering their course.

Bollinger Bands breach?

Bitcoin and ether experienced a significant sell-off, with both assets falling below the lower range of their Bollinger Bands. Bollinger Bands, a technical indicator that follows the 20-day moving average of an asset and charts two standard deviations above and below it, witnessed this downturn.

A breach of the upper or lower range of an asset's price is considered a significant event since it is expected to occur only 5% of the time, as the price typically remains within two standard deviations of its average.

Both assets experienced a significant decline, reaching or approaching "oversold" levels, with ETH's Relative Strength Index (RSI) dropping to 29 and BTC's RSI falling to 35.

The RSI is a scale that ranges from 0 to 100. When the RSI value surpasses 70, it suggests that an asset is experiencing an overbought condition, while values below 30 indicate that the asset is in an oversold state.

Based on data from 2015 to the present, BTC's Relative Strength Index (RSI) has consistently ranged between 35 and 36 on 42 separate occasions, yielding an average 30-day performance of -0.01%. Meanwhile, ETH's RSI has settled between 29 and 31 on 24 occasions since 2017, resulting in an average 30-day performance decline of -15%.

The sudden downward shift contradicts the price movements witnessed in traditional markets on Thursday, where the Dow Jones Industrial Average (DJIA), S&P 500, and Nasdaq Composite all recorded gains of 1%, 0.92%, and 0.82% respectively, in contrast to the declines observed in BTC and ETH prices.

The variation in performance may be attributed, in part, to the increased influence of regulatory concerns affecting the cryptocurrency markets, as the Securities and Exchange Commission (SEC) remains vigilant in monitoring the crypto industry.

The CoinCryptoUs Indices tools emphasize the downturn as both the Bitcoin Trend Indicator (BTI) and Ether Trend Indicator (ETI) indicate that the assets have transitioned into a phase of decline.