SEC's Response to Challenge Groundbreaking XRP Ruling

U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

Documents obtained by CoinDesk reveal that in March 2021, Tether, the issuer of a stablecoin, securely held its funds across multiple financial institutions. These included four banks, two investment management firms, two gold depositories, a gold broker, and even its own sister company Bitfinex.

Additionally, it held investments in commercial paper and other securities issued by a range of entities such as Qatar National Bank QPSC, Barclays Bank PLC, Deutsche Bank AG, Emirates NBD Bank PJSC, and Natwest Group PLC. Notably, a significant proportion of these issuers were Chinese banks and financial institutions.

Tether's previous dependence on commercial paper is not a recent revelation. The company, responsible for issuing and managing the world's largest stablecoin based on market capitalization, openly admitted to investing funds in commercial paper in 2021. However, the full extent of the company's reliance on this particular asset class had not been previously disclosed.

Commercial paper and securities issued by several prominent Chinese banks, including Agricultural Bank of China Ltd, Bank of China Hong Kong, Bank of Communications Co Ltd, Industrial and Commercial Bank of China, China Merchants Bank, China Construction Bank, China Everbright Bank Co, among others, were utilized by Tether as collateral for its token.

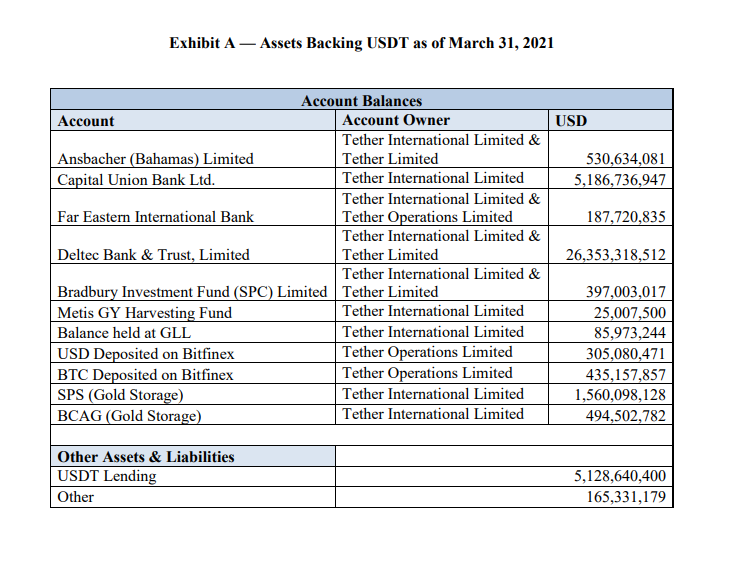

On March 31, 2021, Tether made a claim supported by documents obtained from the New York Attorney General's office (NYAG), which were shared with CoinDesk in response to a state Freedom of Information Law (FOIL) request filed in June 2021. The documents, created on August 4, 2021, provide a snapshot of Tether's operations on that specific day. According to these records, Tether asserted that it held more than $35.5 billion in U.S. dollar equivalents at various financial institutions. Furthermore, the documents disclosed an additional $5.1 billion attributed to "USDT lending" and other assets, resulting in a total asset value of $40.6 billion. This amount closely matched the circulating supply of approximately 40.8 billion USDT at that time.

Therefore, the aforementioned records present a unique yet restricted opportunity to gain insight into Tether's financial situation, which has been a topic of controversy and speculation within the cryptocurrency industry. In February 2021, Attorney General Letitia James declared the resolution of her office's investigation into Tether, stating that there were instances in 2017 and 2018 when Tether's stablecoin, USDT, was not completely backed. However, the recently unveiled documents, which were generated six months after the conclusion of the New York Attorney General's inquiry, neither confirm nor refute this assertion.

Nevertheless, they contribute an additional fragment to unraveling the mystery of Tether's asset storage. Throughout the years, details regarding the company's banking partnerships have emerged only sporadically and incompletely.

Tether (USDT) is recognized as the largest stablecoin globally, playing a crucial role as the underlying asset for cryptocurrency transactions on numerous exchanges. Its primary objective is to maintain a stable value equivalent to the U.S. dollar, and Tether asserts that it holds reserves worth at least one dollar for each USDT token in circulation. However, the company has faced persistent doubts regarding the full backing of USDT, which were seemingly validated by the New York State Attorney General's office in April 2019. The office revealed that Tether had loaned around $850 million from its reserves to Bitfinex, an exchange that shares common corporate officers and parentage with Tether. Bitfinex lost access to these funds when its payment processor was seized by authorities.

CoinDesk submitted a FOIL request seeking documents that provide a comprehensive breakdown of the assets supporting the USDT stablecoin, following Tether's release of its initial public document disclosing the composition of its reserves. At that point, an undisclosed portion of nearly fifty percent consisted of commercial paper of unspecified nature.

Upon reaching a settlement with the NYAG's office in 2021, Tether declared its commitment to publicly disclose the same information regarding its reserves for a minimum period of two years. However, its initial public disclosure in May 2021 consisted merely of two pie charts and a concise statement.

A recently published portfolio report, dated April 7, 2021, includes pie charts that bear resemblance to the previously mentioned documents. However, this report surpasses them in terms of the amount of information it presents, as it discloses precise figures in U.S. dollars for Tether's reserves. Although details regarding fixed-term deposits were omitted, the report reveals that Tether held substantial reserves in certificates of deposit, bonds, and notably, commercial paper.

Based on a letter dated June 4, 2021, Tether stored funds in multiple financial institutions, including Ansbacher (Bahamas) Limited, as previously reported by Forbes in February of the same year. Additionally, Tether maintained accounts with Capital Union Bank in the Bahamas, a relationship that had been reported by the Financial Times. Furthermore, Tether utilized the services of Far Eastern International Bank in Taiwan, an association that had been disclosed by Bloomberg without revealing specific names. However, the majority of Tether's assets, surpassing $26 billion as of March that year, were held in Deltec Bank and Trust based in the Bahamas. The Deltec relationship became public in November 2018 when Tether released a letter on the bank's letterhead, which gained attention due to the absence of an employee's name and a distinctive squiggly signature. Subsequently, Deltec's chairman confirmed the authenticity of the document to CoinDesk.

As of 10:30 p.m. ET on March 31, 2021, CoinGecko reported that the circulating supply of USDT amounted to a staggering $40.8 billion.

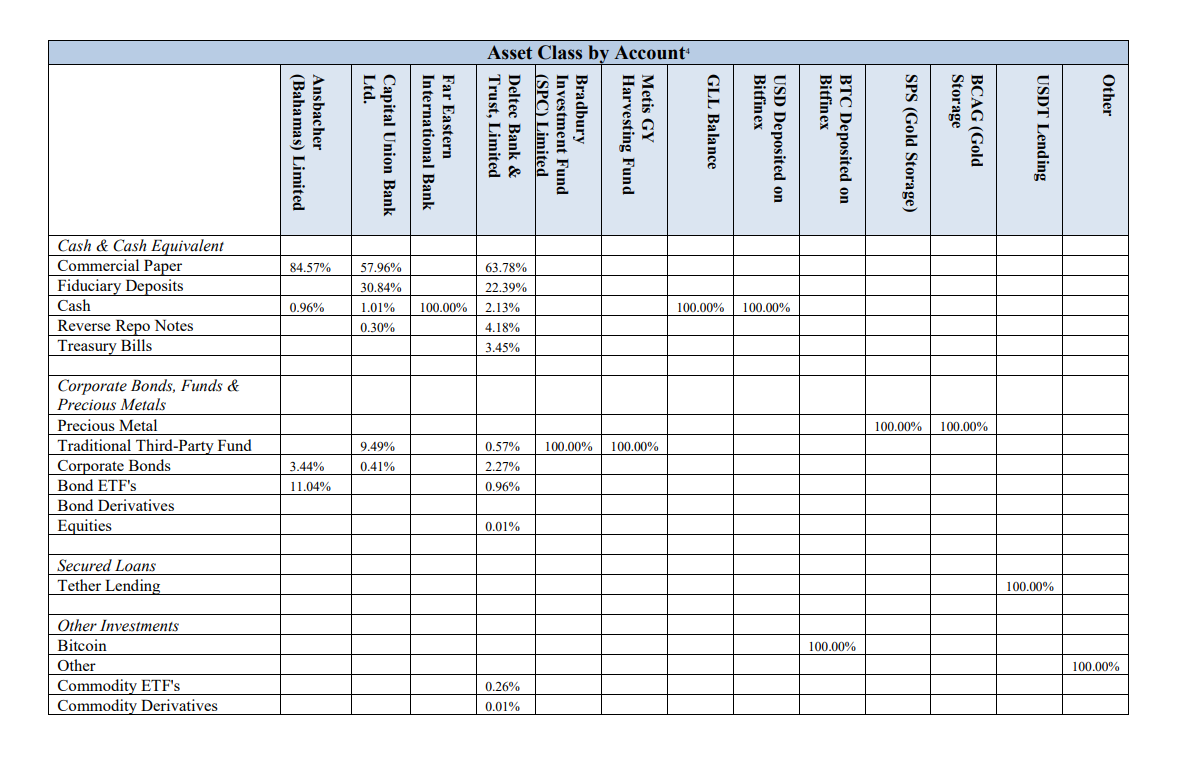

The aforementioned report further elaborates on the assets held by each institution, providing confirmation that Tether had a substantial portion of its reserves invested in commercial paper.

In another portfolio report, released by Ansbacher, a more detailed breakdown reveals that approximately 85% of Tether's assets held at the financial institution were in the form of commercial paper. The remaining portion consisted mainly of corporate bonds, accounting for 13.7% of Tether's holdings. The rest of their portfolio comprised high yield bonds, floating rate notes, and credit accounts.

The document lacked a signature.

Likewise, Capital Union Bank issued a report stating that approximately 88% of Tether's holdings consisted of "liquid assets," although it did not furnish a more detailed breakdown.

A number of these documents provide extensive information about the interactions between Tether's legal team and the New York Attorney General's (NYAG) office right after they reached a resolution to the NYAG's lengthy investigation into Tether.

Based on one of these communications, the NYAG's office expressed inquiries regarding Tether's commercial paper holdings subsequent to the resolution.

“Regarding Tether’s acquisition of commercial paper assets, Tether maintains accounts at different banks as identified in our prior letter. Tether requests quotes for commercial paper offerings from those banks who, in turn, request these from brokers and other counterparties who either deal directly with issuers for the issuance of commercial paper, or who deal on secondary markets to purchase commercial paper,” read a letter from Tether’s outside counsel sent on June 25, 2021.

CoinDesk acquired the documents following an almost two-year legal dispute in which Tether attempted to prevent the NYAG from disclosing them. CoinDesk was represented by Klaris Law in court and achieved a triumph in February.

Before this article was published, Tether released a statement acknowledging that the documents had been released by the NYAG FOIL officer. This occurred because the company failed to take the required actions to appeal a court decision mandating the disclosure of the documents. Subsequently, on Friday, a second statement was published, aiming to provide a purported description of the contents contained within the documents.

“Tether initiated these proceedings in the first instance to prevent the public dissemination of confidential customer data and to prevent the use of sensitive commercial information that could potentially be exploited by malicious actors,” the first statement said. “However, our ongoing and demonstrable commitment to transparency means that we must prioritize openness over further time-consuming and unproductive American litigation that distracts from the real issues facing our community.”

Tether did not provide an immediate response to a comprehensive set of inquiries regarding certain documents.

Tether expressed its concern in the statement regarding the sudden depegging of USDT, which coincided with the sale of millions of dollars' worth of the cryptocurrency on decentralized finance pools. The company found it suspicious that these events occurred on the same day that the New York government shared the documents with CoinDesk.

Indeed, the stablecoin experienced a temporary detachment from its peg before 07:00 UTC (3:00 a.m. ET) on June 15, which was at least five hours prior to the NYAG FOIL officer sharing the documents with CoinDesk's legal representatives.

“CoinDesk learned from our lawyers on June 12 that we would finally receive the documents after a long court dispute in which Tether tried to block their disclosure,” said Marc Hochstein, Executive Editor of CoinDesk. “We did not share the news of our win with anyone outside our editorial staff until after we received the documents on the morning of June 15 in New York, hours after USDT lost its peg. CoinDesk stands by the integrity of our reporting.”

Editor’s note: This article is based on documents received via a Freedom of Information Law request to the New York Attorney General’s office. CoinDesk is reviewing the documents, in part to ensure no individual’s private information is inadvertently shared and redacting where appropriate before releasing them in full.

Source Coindesk