U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Bitcoin Approaches Formation of Death Cross as Dollar Index Hints at Golden Crossover

Good morning. Here’s what’s happening:

Prices: Crypto majors are kicking off the trading day on a positive note, buoyed by a short squeeze that is driving up the price of bitcoin.

Insights: In June, the total value locked in Aave's v3 platform for smart contract lending has surged by 15%, further building on its strong momentum in 2023.

Prices

|

$28,359

+1562.7 ▲ 5.8%

|

$1,793

+59.1 ▲ 3.4%

|

1,166

+45.8 ▲ 4.1%

|

|

S&P 500

4,388.71

−20.9 ▼ 0.5%

|

Gold

$1,948

−10.0 ▼ 0.5%

|

Nikkei 225

33,388.91

+18.5 ▲ 0.1%

|

BTC/ETH prices per CoinCryptoUs Indices, as of 7 a.m. ET (11 a.m. UTC)

Crypto Rises as Asia Opens

Bitcoin and ether have started the Asia trading day on a highly positive note, with the world's largest digital asset experiencing a notable 5.8% surge to reach $28,359. At the same time, ether has also witnessed a promising increase of 3.4%, bringing its value up to $1,793.

The CoinDesk Market Index has surged by 4.1% to reach 1,166, indicating a significant increase.

"Bitcoin's move above USD $28,000 also comes with the coin's share in the aggregate crypto market cap topping 50% for the first time in two years. Unlike most other digital assets, bitcoin has not been implicated in any of the regulatory complexity, we've seen coming out of the U.S.,” stated Strahinja Savic, head of data and analytics at FRNT Financial, a crypto platform based in Toronto, in a communication with CoinDesk.

Savic emphasizes that BlackRock's submission of a bitcoin ETF application has unequivocally highlighted the unwavering institutional interest in bitcoin, despite the recent market downturns and bankruptcy cases witnessed earlier this year and in late 2022.

Joe DiPasquale, the CEO of BitBull Capital, highlights the bitcoin ETF applications and the introduction of a newly established cryptocurrency exchange supported by institutional investors called EDX as compelling factors that bolster the optimistic outlook for the crypto market.

“It wouldn’t be surprising if Bitcoin continues to lead the market for now,” he said. “On the top side, $30k is the obvious resistance."

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Bitcoin | BTC | +5.5% | Currency |

| Avalanche | AVAX | +5.4% | Smart Contract Platform |

| Gala | GALA | +4.3% | Entertainment |

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| XRP | XRP | −0.3% | Currency |

Insights

Aave's v3 TVL Rises in June

Aave, the smart contracts crypto lending platform, has sustained its positive momentum throughout June.

Blockchain analytics firm DefiLlama's data reveals a striking surge in the total value locked (TVL) of version 3 (v3) blockchain, soaring by 15% since the start of the month to an impressive $1.76 billion. Aave, in particular, has experienced an extraordinary 300% surge in TVL since January 1st, outpacing other major cryptocurrencies by a considerable margin. In comparison, Bitcoin and Ether, the two largest digital assets based on market capitalization, have witnessed substantial growth rates of approximately 70% and 50% respectively in 2023.

The surge in Aave's performance serves as compelling evidence of the growing interest in DeFi protocols, which eliminate the reliance on third-party institutions for transaction execution. Simultaneously, a recent banking crisis resulting in the downfall of three prominent regional banks in March has eroded trust in traditional financial service providers that have traditionally played a central role in lending markets.

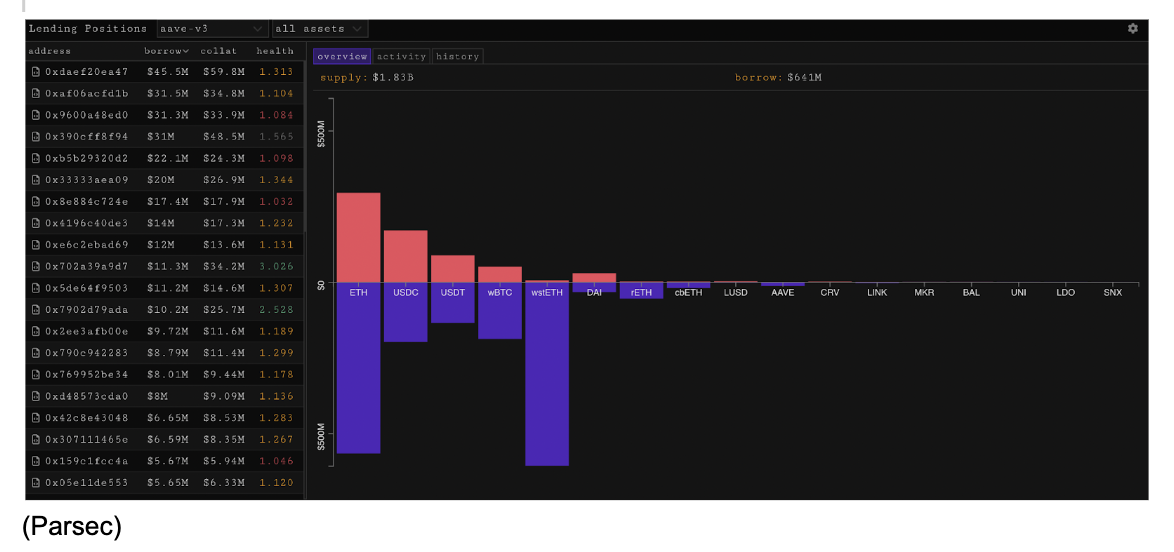

As of the current time, users of Aave have contributed approximately $1.83 billion worth of assets and borrowed $641 million on Aave's version three (v3), according to on-chain markets terminal Parsec. This data emphasizes the substantial financial activity taking place within the protocol.

The combined value of assets borrowed by the top five borrowers on Aave v3 exceeded $227.2 million, with loans amounting to approximately $181.4 million. These figures represent around 28% of the total loans issued on the Aave v3 platform. The most commonly transacted crypto assets on Aave include Ether, stablecoins, wrapped Bitcoin, and liquid staking tokens, showcasing their widespread popularity within the DeFi ecosystem.

Important events.

2:00 p.m. HKT/SGT(6:00 UTC) United Kingdom Consumer Price Index (YoY/May)

8:30 p.m. HKT/SGT(12:30 UTC) Canadian Retail Sales (MoM/April)

6:45 a.m. HKT/SGT(22:45 UTC) Trade Balance NZD (YoY/May)