MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

DeFi and Credit Risk

Bitcoin Approaches Formation of Death Cross as Dollar Index Hints at Golden Crossover

Can the implementation of the "Howey Test" ignite a new wave of optimism in the cryptocurrency market?

There is always something intriguing to explore in the realm of digital assets. Today, the focus might be on market structure, while tomorrow it could shift to the underlying technology. And occasionally, such as on a Wednesday, securities law might capture your attention.

In my previous role as an equity research analyst, almost everything I dealt with on a daily basis revolved around "security." However, when it comes to crypto assets, the situation has been far from simple. As the sector faces increasing regulatory scrutiny, the focus has shifted to determining what qualifies as a security and what doesn't, becoming a central topic of discussion.

From my perspective, establishing a clear and transparent definition of what qualifies as a security and its consistent application would greatly benefit the crypto markets.

Enhancing clarity is of utmost importance, as it will greatly benefit all parties involved, particularly individuals currently holding or considering holding crypto assets.

The Howey Test, although seemingly simple, can also resemble a Rorschach test, as its interpretation relies on the individual conducting the assessment. In essence, the Howey test establishes the classification of securities by employing four specific criteria.

- An investment of capital

- In a common enterprise

- With the expectation of profit

- Driven by the efforts of others

If an asset satisfies all four criteria of the Howey Test, it is classified as a security and must be registered with the SEC, as mandated by the Securities Act of 1933 and 1934. Conversely, if an asset fails to meet these criteria, it is not considered a security. However, it is important to note that complying with the four prongs of the Howey Test can result in substantial legal fees amounting to millions of dollars.

Recently, the significance of the test has heightened due to the Securities and Exchange Commission (SEC) assigning the securities classification to numerous cryptocurrencies.

By doing so, the assets and any organization involved in their transfer fall under the jurisdiction of the SEC.

The whitepaper on the SEC's "Framework of Investment Contract Analysis of Digital Assets" suggests that digital assets meet the initial criteria. Firstly, investors can obtain digital assets by purchasing or exchanging them for something valuable. Secondly, the SEC asserts that a "common enterprise typically exists" when assessing digital assets.

As cryptocurrencies fulfill these criteria, the SEC is now able to focus its attention on them, specifically those associated with a centralized entity and/or created with the intention of fundraising.

For instance, the SEC is likely regarding Solana's SOL as a security partially due to the presence of the Solana Foundation and its board of directors. However, the characterization by the SEC has been contested by the Solana Foundation.

The third and fourth criteria are where the situation becomes intriguing, especially concerning bitcoin (BTC) and ether (ETH). In numerous aspects, these criteria seem to set bitcoin apart from ether and other tokens.

The SEC's whitepaper on digital assets specifically delineates the “responsibilities performed and expected to be performed by an associated person (AP), rather than an unaffiliated, dispersed community of network users”.

The SEC further declared that the activities of securities APs play a crucial role in establishing or bolstering a market for digital assets, influencing their prices, facilitating their creation or issuance, or exerting control over their supply.

Bitcoin and Ethereum enthusiasts can take solace in these domains.

Although there are market observers who speculate that the recent regulatory efforts by the SEC aim to encompass the entire cryptocurrency market, it seems that bitcoin and ether, the two largest cryptocurrencies in terms of market value, are excluded from this increasing scrutiny when evaluated through the application of the Howey test. Notably, the SEC deliberately left out both assets from any lists that could potentially classify them as securities. In fact, their decentralized governance and issuance make them more similar to commodities rather than securities.

At present, bitcoin and ether collectively represent nearly 70% of the total market capitalization of the cryptocurrency market. Following the SEC's legal action against Binance, the market capitalization dominance of BTC has experienced a 3% surge.

The market share of ETH has decreased from 20.52% to 20.1%, largely driven by the decline in bitcoin's dominance. However, when considering their combined market capitalization dominance, it has increased by approximately 2%. Additionally, the correlation between bitcoin and ether has risen by 6%.

Although bitcoin has been referred to as "digital gold" and ether as "digital oil," a more fitting term for both could be "digital water." This analogy stems from the immutable nature of their underlying code, symbolizing their solid state, while their capacity to adapt and accommodate various regulatory environments represents their liquid state.

Interestingly, the apparent inapplicability of the Howey Test could paradoxically instill confidence in new investors and divert the SEC's attention towards a diminishing portion of the market.

Time to Monitor Crypto Liquidity

In the world of cryptocurrency markets, much of the emphasis is placed on closely analyzing price fluctuations, often overlooking the importance of underlying liquidity patterns. By incorporating such perspectives, market participants can enhance their ability to navigate the market effectively and gain a clearer understanding of our current position within the market cycle.

Price fluctuations observed on low trading volumes typically carry a lower degree of reliability compared to those accompanied by higher trading volumes. Thin volumes indicate limited market engagement at a particular price level, which can potentially result in heightened price volatility and reduced market depth. On the other hand, higher trading volumes indicate a broader participation in the market, signifying a stronger consensus and establishing a more dependable basis for price movements. Consequently, higher trading volumes enhance the credibility of the signal.

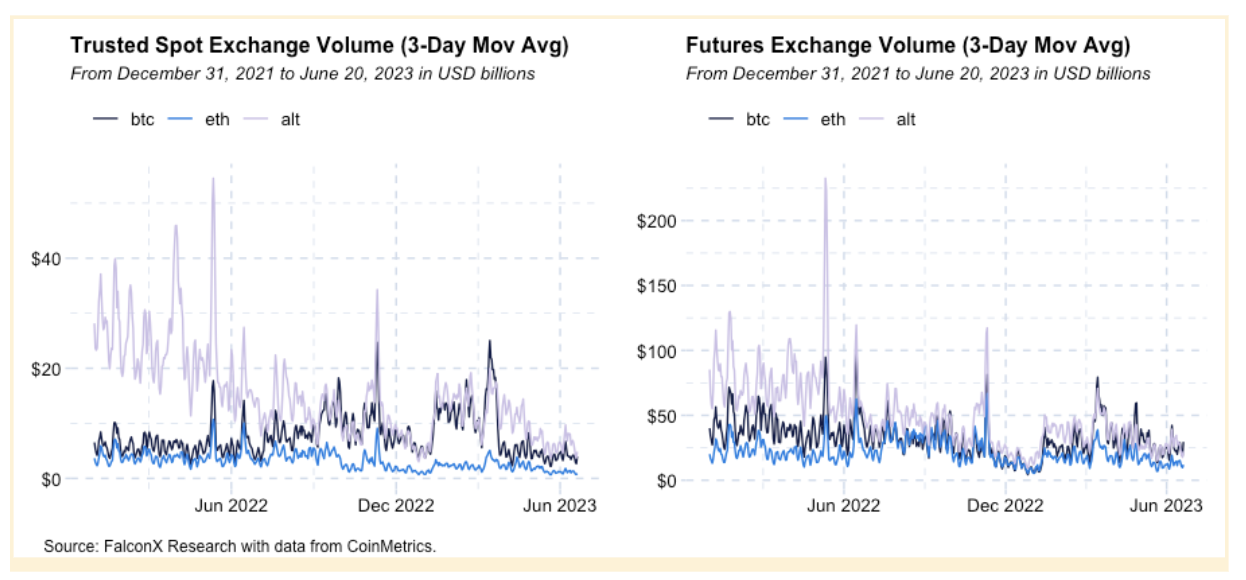

As depicted below, trading volumes in the cryptocurrency market have generally been declining for spot trading (left) and futures trading (right).

(CoinMetrics)

Certain instances can be attributed to shifts in market structure rather than investor preferences, such as the notable decline in BTC volumes in March 2023 following Binance's decision to discontinue its zero-fee trading policy for certain prominent market pairs.

In other instances, changes in market preferences have become apparent. Apart from a few exceptions, the trading volumes of assets other than BTC and ETH have experienced significant declines as investors shift their focus towards more established investment opportunities. Notably, the decrease in liquidity has been particularly evident for DOGE, Litecoin (LTC), and SOL among the well-known cryptocurrencies.

Interestingly, there are indications of early stabilization or even reversal in some of these liquidity trends.

Spot trading volumes, which experienced the most significant decline in 2023, have shown a slight recovery and currently sit slightly above the volume lows of 2022. This represents an improvement compared to the recent volume figures that reached the lowest levels since late 2020.

This slight recovery in spot volumes has been accompanied by an improvement in market depth. Another crucial measure of liquidity, orderbook depth, has shown signs of improvement for BTC and ETH since the beginning of May, with ETH experiencing a greater improvement compared to BTC. This recovery is particularly noteworthy considering the recent reports of two major crypto liquidity providers scaling back their U.S. trading activities. Under normal circumstances, such a development would imply a decline in orderbook depth, but instead, we have witnessed an improvement.

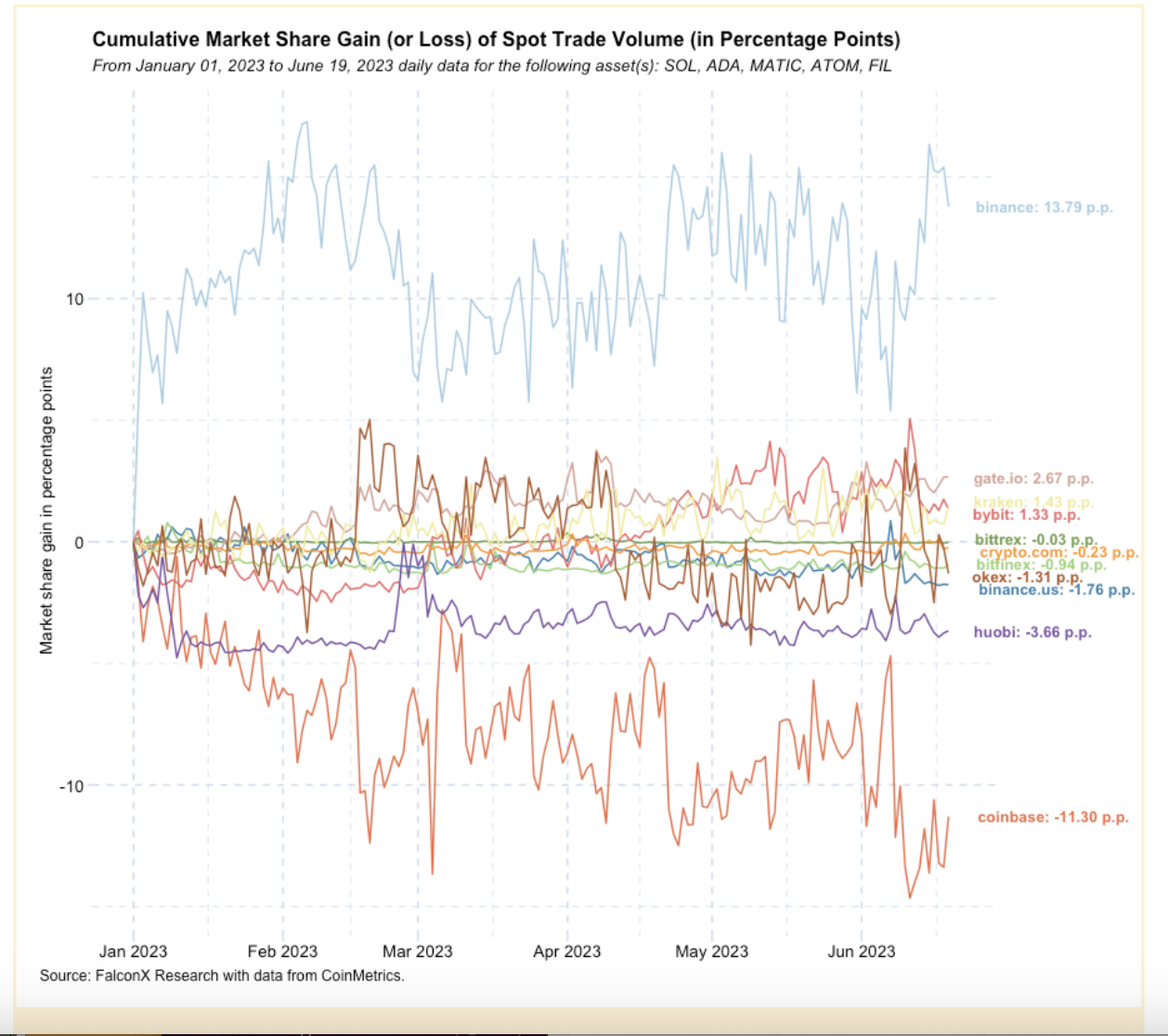

Regarding assets other than BTC and ETH, the market's attention is focused on liquidity due to the repercussions of the SEC charges against Coinbase and Binance. Despite the news breaking two weeks ago, trading volumes for the five most prominent assets by market capitalization (SOL, ADA, MATIC, FIL, and ATOM) have not shown significant changes. However, there has been a notable shift in trading activity for these assets, as it appears to have shifted from the U.S. to international markets since the beginning of the year, as indicated by the chart below.

(CoinMetrics)

Bear markets often conclude with a subtle rather than dramatic resolution. Indifference and apathy are commonly observed as characteristic indicators of the final phase in the psychological framework of a bear market, which draws inspiration from psychologists and encompasses stages of denial, anger, bargaining, depression, and acceptance.

Based on the current state of liquidity in the crypto market, it appears that we have entered the advanced stage of grief. However, there are some intriguing early indicators suggesting a possible stabilization or even a cautious reversal. In previous market cycles, sustained recoveries in crypto market liquidity have served as initial confirmation signs of upcoming bull markets. Although we have not observed such signals at present, it is advisable to start monitoring them closely as the opportune time may be upon us.

Takeaways

THE SURGE: Bitcoin surpassed the $30,000 mark for the second time this year, fueled by an optimistic market sentiment as several traditional finance (TradFi) entities continue to embrace the crypto space.

BLACKROCK SEEKS A SPOT: On Thursday afternoon, the iShares division of BlackRock, a leading fund management company, submitted documents to the U.S. Securities and Exchange Commission (SEC) to establish a Bitcoin (BTC) exchange-traded fund (ETF) focused on spot trading.

DEUTSCHE APPLICATION: Deutsche Bank AG, a prominent financial services corporation, announced on Tuesday that it has submitted an application to obtain regulatory approval to function as a cryptocurrency custodian in Germany. This decision follows closely after asset management titan BlackRock's recent filing with the SEC to establish a spot Bitcoin ETF. A spokesperson from Deutsche Bank confirmed the development, stating, "I can confirm that we have applied for the BaFin license for crypto custody," referring to Germany's financial regulatory authority.

TOKENS AS SECURITIES?: CoinDesk columnist Daniel Kuhn asks “what could users do with a token that’s been labeled a ‘security?’” Kuhn writes that if a blockchain is “sufficiently decentralized,” then consumers should be able to trade the token and use its source code. “So what can a user do with a token that is a security?” Kuhn asks. “Everything you could with a token before it was declared a security.”