NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Binance Supercharges Bitcoin and Ether Trading in Argentine, Brazilian, and South African Currencies with Exciting Fee Promotion

Bitcoin's (BTC) recent surge to its highest levels in two months has sparked an upsurge in demand for call options, leading to increased activity in the options market.

On Wednesday, the price of the cryptocurrency soared to $30,800, reaching its highest point since April 14. This development has brought enthusiasm to the market, especially due to the recent influx of spot bitcoin ETF applications from prominent financial firms such as BlackRock (BLK), WisdomTree, and Invesco (IVZ). These applications serve as a testament to the ongoing institutional interest in the world's largest cryptocurrency.

The market trajectory has experienced a sudden shift since last week, when prices briefly dipped below a critical support level of $25,200. As a result, traders are now looking towards options as they pursue the ongoing rally.

On Wednesday, the total value of bitcoin options contracts traded on major exchanges, including Deribit, reached a staggering $3.3 billion. This remarkable figure represents the highest daily trading volume in the past three months. Impressively, Deribit alone accounted for over 80% of the global tally.

"We have seen the biggest trading volume in three months. There is a lot of interest in buying call options," Deribit's Asia business development personnel Lin Chen told CoinDesk.

Options provide investors with the opportunity to purchase or sell the underlying asset, such as bitcoin, at a predetermined price on a future date. When acquiring a call option, the buyer obtains the privilege to buy, while a put option grants the buyer the right to sell. Traders frequently opt for call options as an affordable means of leveraging their bullish speculation.

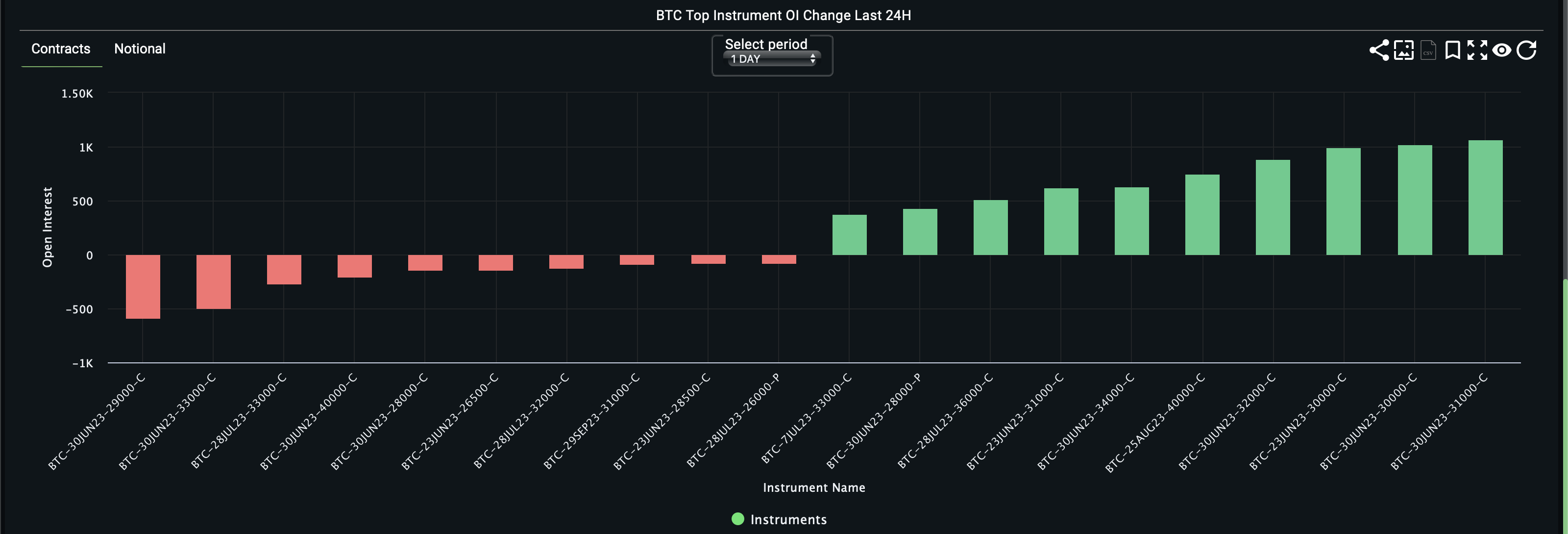

The chart shows bias for higher strike call options. (Laevitas)

In the past 24 hours, traders have shown considerable interest in call options with strike prices of $30,000, $31,000, $32,000, and $40,000, as reported by Laevitas.

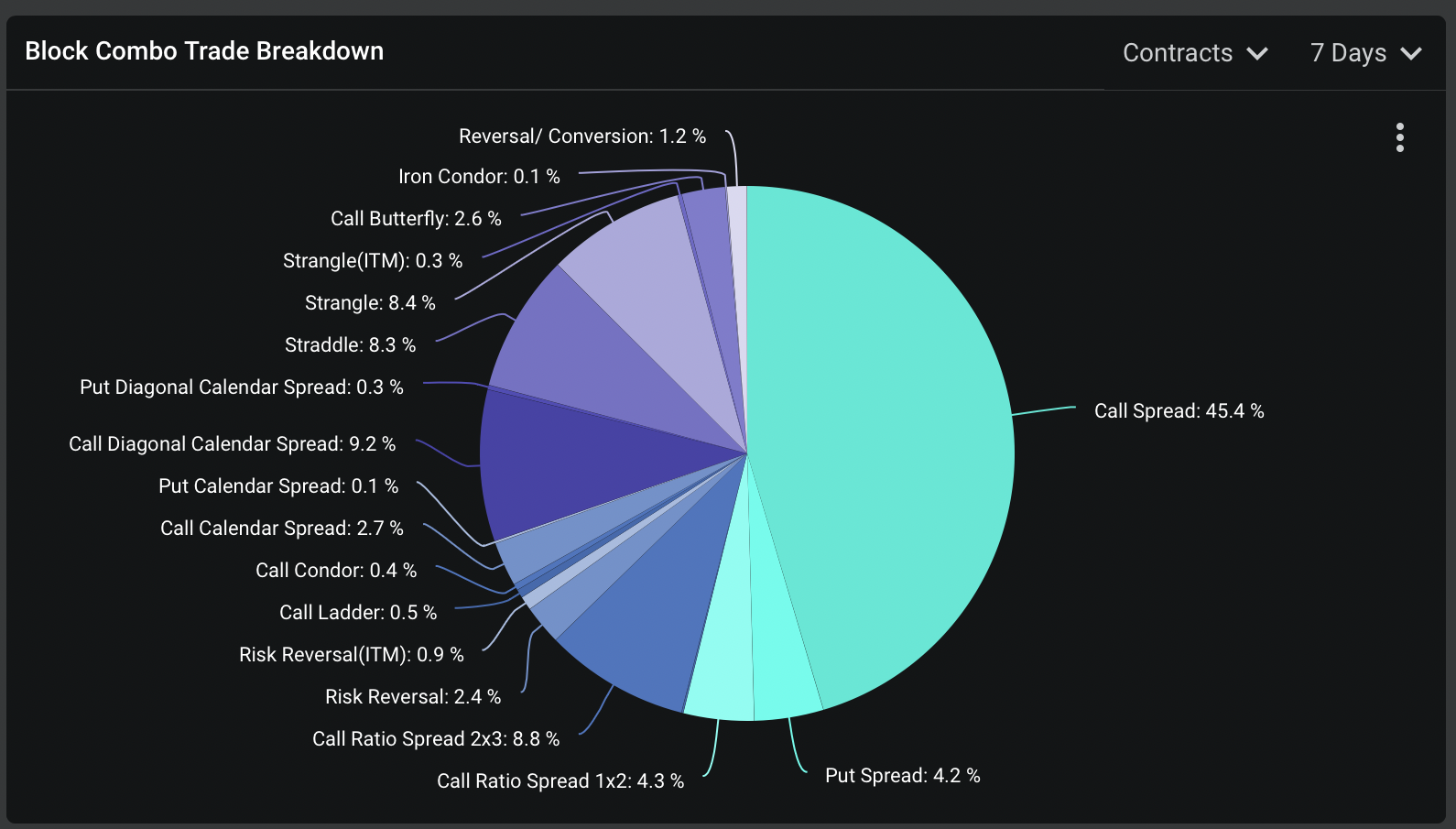

Over the last week, call spreads have represented 45% of the overall block flows, which encompass significant orders executed on over-the-counter liquidity networks such as Paradigm before being listed on exchanges.

Call spread strategies have been most preferred in the past seven days. (Amberdata)

Patrick Chu, director of institutional sales and trading at Paradigm, explains that due to the price rally, certain individuals who had sold calls against their cryptocurrency holdings, also known as call overwriters, are now compelled to repurchase their bullish positions. Call overwriting, a widely used strategy to generate extra yield in a market that is either stagnant or experiencing a downward trend, involves selling call options on owned cryptocurrencies.

"Mostly, people have been buying back the topside, especially option overwriters given the rapid upward move," Chu said.

DVOL spikes

The soaring interest in options has propelled Deribit's bitcoin volatility index, DVOL, to a remarkable 59.24, reaching its highest point since the beginning of April, as reported by Amberdata.

The DVOL is a metric that quantifies the 30-day implied volatility (IV) of Bitcoin, which is calculated using Deribit's options order book. As the demand for options increases, the IV also rises, and conversely, when the demand decreases, the IV tends to decrease as well. The IV represents investors' anticipated level of price volatility within a defined timeframe.

"The increased demand for options has pushed up the DVOL," Deribit's Chen said.

In traditional markets, implied volatility typically increases during periods of risk aversion. However, Chen explained that Deribit's DVOL tends to rise when prices are on the upswing.

The DVOL has seen a notable rise in the past seven days. (Amberdata)

Since the beginning of the year, there has been a noticeable positive correlation between the implied volatility and spot prices of Bitcoin.

"The DVOL is moving reactively on the recent headlines and the last three days' spot move. Prices were very contained in the recent two months and realized volatility has been low overall. The market was caught a bit short [volatility] going in and people are scrambling to cover," Chu noted.

Source Coindesk