CFTC Initiates Enforcement Sweep Targeting Opyn and Other DeFi Operations

Binance Supercharges Bitcoin and Ether Trading in Argentine, Brazilian, and South African Currencies with Exciting Fee Promotion

Ether Whales Accumulate $94 Million in ETH Amidst Price Dive to $1.6K

Key takeaways

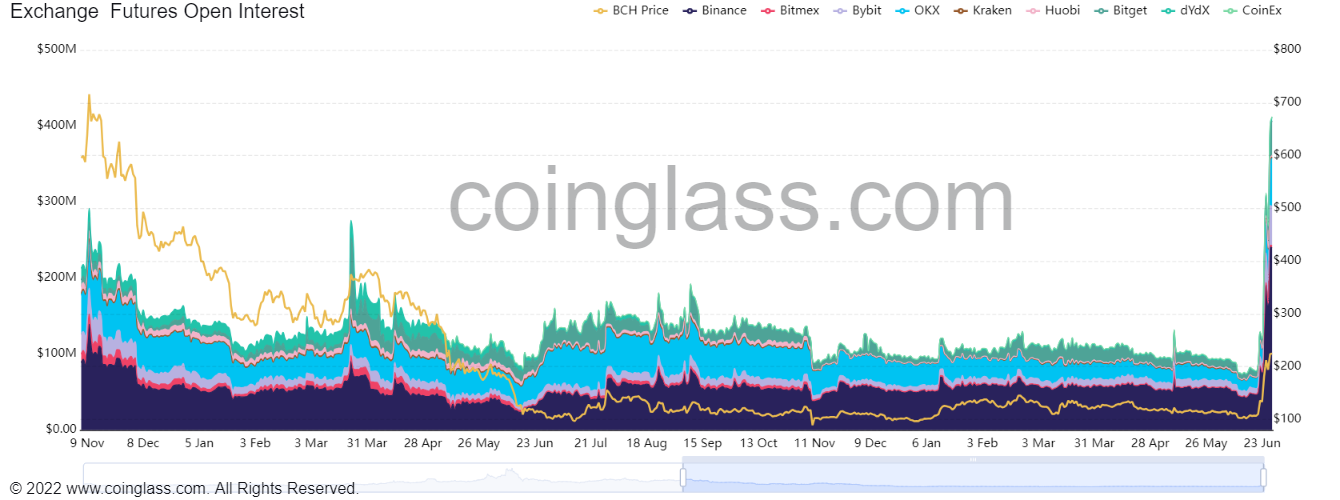

- Bitcoin Cash experienced a tremendous surge in open interest, exceeding an impressive milestone of $400 million.

- An increasing open interest signifies greater capital inflows and enhanced market sentiment.

- The introduction of plans to scale the 'CashTokens' system has also sparked a resurgence in interest.

Interest in futures contracts tied to Bitcoin Cash (BCH) tokens has recently soared, reaching levels not seen since May 2021. This surge in interest can be attributed to a resurgence in both activity and value within the Bitcoin offshoot network.

Recent data reveals a remarkable surge in BCH prices, which have soared by 100% in just one week. This impressive performance has positioned BCH among the most successful tokens with a market capitalization surpassing $1 billion. In addition to BCH, Bitcoin (BTC) and ether (ETH) have also shown significant growth, with gains of 13% and 8% respectively during this period.

Data reveals a remarkable upswing in BCH open interest, indicating the number of outstanding futures contracts, soaring to over $400 million on Monday, a substantial jump from the previous week's $75 million. The majority of trading activity driving this surge was witnessed on the renowned crypto exchange Binance, where traders eagerly engaged in BCH long and short positions, collectively amounting to an impressive $240 million.

BCH trading interested has surged to 2021 levels. (Coinglass)

A surge in open interest signifies either an influx of fresh capital into the market or an expansion of investments by current participants. This metric serves as an effective tool to gauge market sentiment and assess the robustness of price movements.

Two significant factors that have likely fueled the sudden surge in trading activity for BCH are a network upgrade and a prominent listing on a well-known exchange.

In May, Bitcoin Cash experienced a network hard fork that brought about enhancements in the security and privacy of the emerging network. Additionally, the upgrade introduced the concept of "CashTokens," which is a scaling solution enabling developers to create decentralized applications directly on the Bitcoin Cash blockchain.

Further advancements included the implementation of reduced transaction sizes, resulting in faster transaction processing times. Moreover, the integration of smart contracts functionality enables Bitcoin Cash-based applications to provide a wide range of services to users, including recurring payments, derivatives trading, crowdfunding opportunities, and more.

Crypto research firm Santiment suggests that the introduction of EDX Markets has probably provided additional advantages to BCH in other areas as well.

The recently launched exchange, supported by renowned players in traditional finance such as Fidelity Digital Assets, Charles Schwab, and Citadel Securities, commenced trading last Tuesday. In addition to bitcoin (BTC), ether (ETH), and litecoin (LTC), the exchange also supports BCH, further enhancing its market presence.

The abrupt price movement has captured the interest of retail traders, leading to a surge in social discussions about the token, reaching their highest level in three years. Additionally, trading volumes for this year have reached a new record, as reported by Santiment last week.