NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

CFTC Initiates Enforcement Sweep Targeting Opyn and Other DeFi Operations

Takeaways

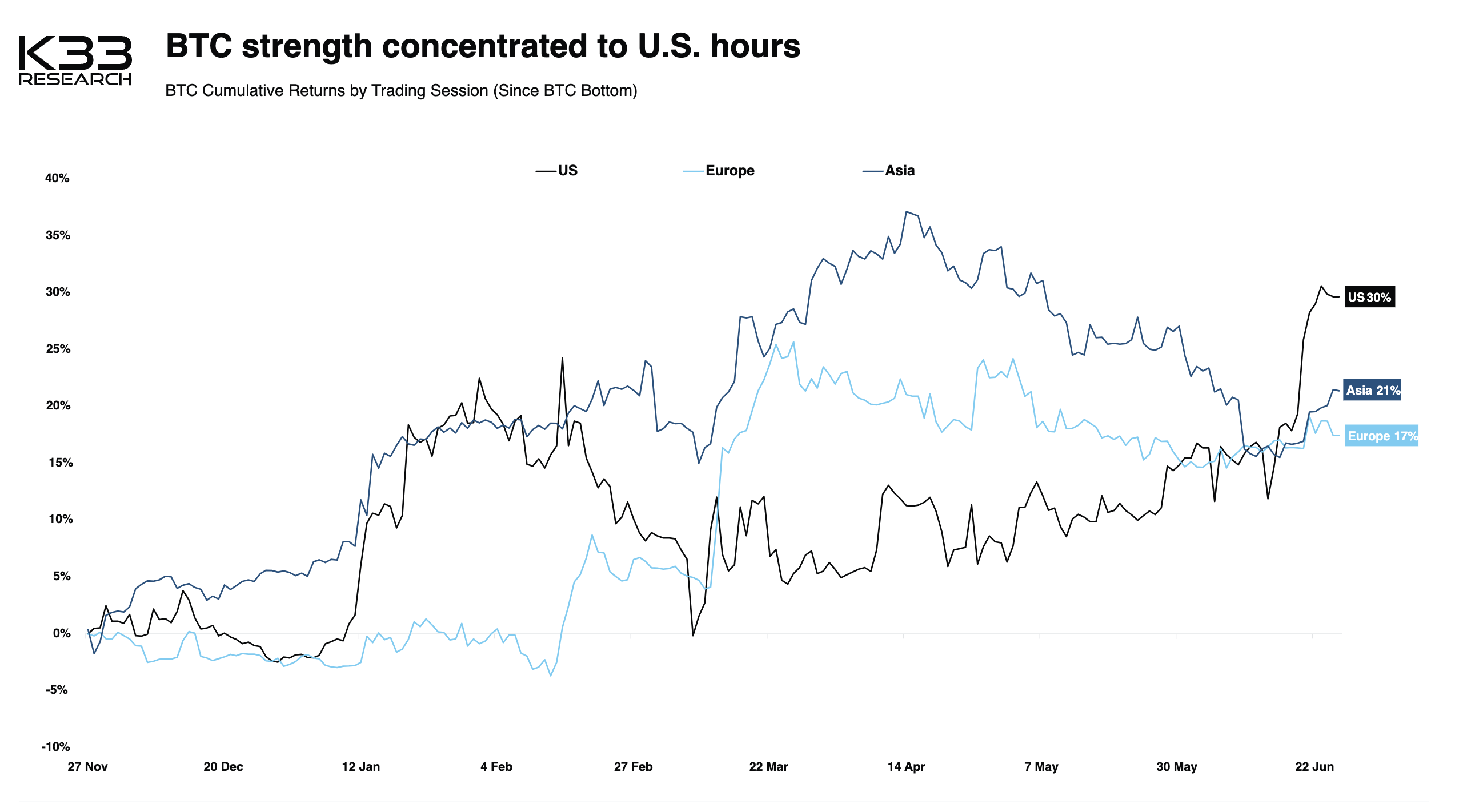

- K33 Research discovered a noteworthy surge in Bitcoin (BTC) during U.S. market hours, with a substantial 30% gain in value. In addition, BTC dominated the trading landscape by constituting a staggering 50% of the total trading volume.

- The negative correlation observed between bitcoin and U.S. equities indicates that investors sought the token as a means of diversification.

- "We may be at a generational moment" in crypto adoption, Hashdex CIO said.

The rapid ascent of bitcoin (BTC), the largest cryptocurrency by market capitalization, has been propelled by a substantial increase in institutional participation, drawing a substantial influx of U.S. investors into the digital asset realm.

In a recent report, K33 Research, a crypto analytics firm, highlighted that Bitcoin's price gains and trading volume have been predominantly concentrated during U.S. market hours, serving as the primary driving force behind BTC's robustness.

Bitcoin has exhibited a remarkable performance this year, with a staggering 85% surge, as reported by CoinCryptoUs. This surge has outpaced the majority of cryptocurrencies in the market, showcasing Bitcoin's dominance. Contributing to this upward trend is the active involvement of heavyweight financial institutions like BlackRock, Fidelity, and Citadel, whose participation has sparked significant optimism among investors.

Smaller cryptocurrencies have faced challenges due to growing regulatory scrutiny regarding their status as unregistered securities. As a result, trading platforms have taken measures to mitigate risks by limiting the availability of popular tokens.

BTC has demonstrated impressive performance during U.S. market hours, accumulating approximately 30% in gains since hitting a low of around $16,000 at its bottom. This remarkable growth has far surpassed the trading sessions in Asia and Europe. Notably, the surge in U.S. activity can be attributed to the recent filing made by BlackRock, a renowned asset management firm, for a spot BTC exchange-traded fund on June 14.

K33 Research/TradingView)

In addition, Bitcoin's recent surge has coincided with its detachment from the performance of U.S. equities, including the S&P 500 and Nasdaq indices. According to K33, the 30-day correlation between Bitcoin and these indices turned negative last week, marking the first time since January 2021.

"This illustrates that U.S. traders are allocating in BTC due to idiosyncratic reasons" as a portfolio diversification, Vetle Lunde, senior analyst at K33, wrote.

Institutional investors revive

BlackRock's initiative has breathed new life into institutional activity in the BTC market.

K33 data reveals that open interest in the Chicago Mercantile Exchange (CME) futures market, widely favored by sophisticated investment firms, is edging closer to its historic peak.

A recent report by CoinShares revealed a remarkable surge in digital asset funds, as they garnered an impressive $199 million in inflows last week. This influx stands as the largest recorded in almost a year, with an astounding 94% of the total inflows being attributed to funds centered around bitcoin.

Samir Kerbage, the chief investment officer at Hashdex, a crypto asset management firm, observed that the recent developments indicate a pivotal moment in the institutional adoption of cryptocurrencies.

"We may be at a generational moment in time for individual crypto investors," he said.

"The current institutional interest we are witnessing is far from the opportunistic FOMO [fear of missing out] we have seen in the past that can push prices up in the short term," Kerbage wrote. "These institutions move slowly and deliberately and invest for the long term-once they are in, they are in."