NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Binance Supercharges Bitcoin and Ether Trading in Argentine, Brazilian, and South African Currencies with Exciting Fee Promotion

Matrixport, a prominent crypto services provider, was among the limited number of companies that expressed optimism towards bitcoin (BTC) in the latter part of the previous year. Their latest forecast suggests that the primary digital currency could surge significantly and reach a staggering $125,000 by the conclusion of 2024.

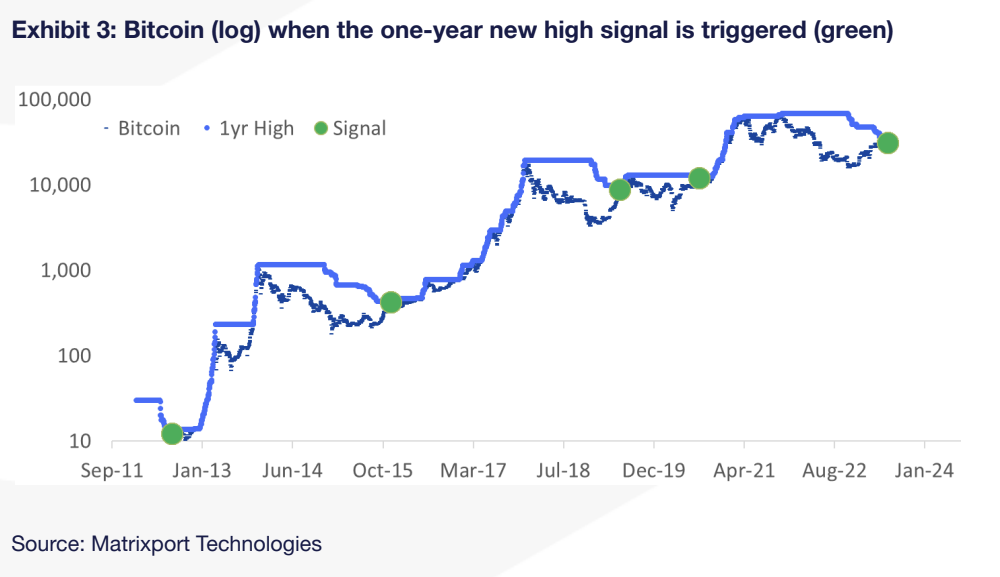

The prediction relies on data indicating a prolonged period of bullish market conditions, characterized by a remarkable increase in market value. This surge occurs after prices validate the conclusion of a bear market by reaching a 12-month high, marking the first time in at least a year.

The signal was activated in the latter part of the previous month when prices surpassed $31,000, reaching their highest level since June 2022. Similar signals were observed in August 2012, December 2015, May 2019, and August 2020, all of which led to subsequent market rallies in the following years.

"On June 22, 2023, bitcoin made a new one-year high, marking the first time in a year. This signal has historically indicated the end of bear markets and the start of new crypto bull markets," Markus Thielen, head of research and strategy at Matrixport, said in a report shared with CoinDesk.

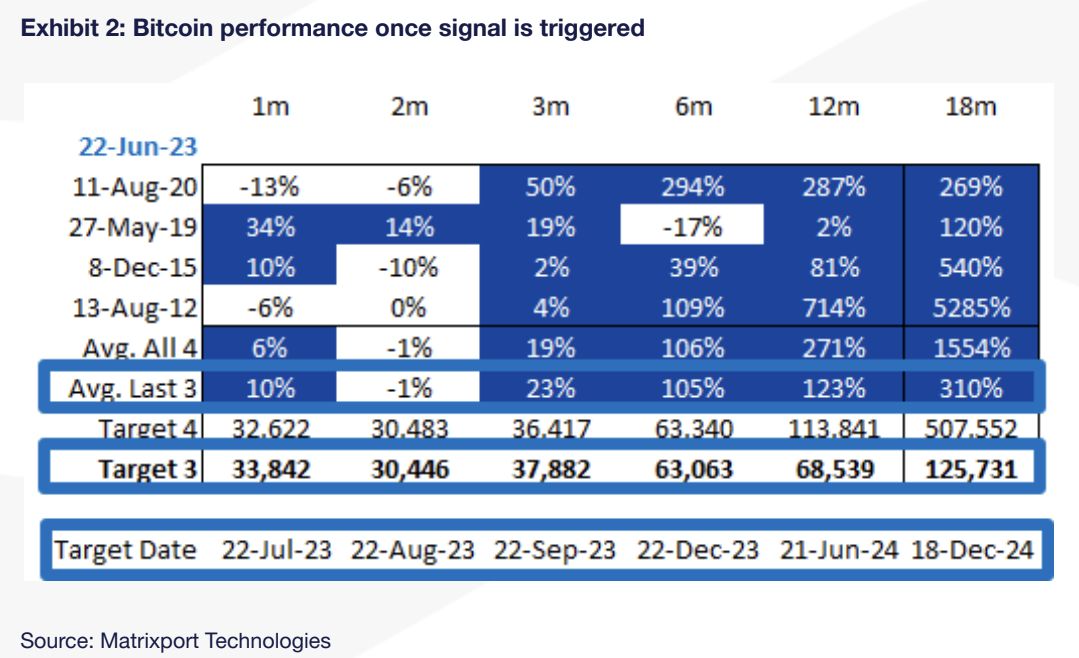

"If history is any guide, bitcoin prices could climb by +123% over twelve months and by +310% over eighteen months – based on the average return of the signals triggered in 2015, 2019 and 2020. That would lift prices to $65,539 in twelve months and $125,731 over eighteen months," Thielen added.

Thielen ignored the 2012 signal and the subsequent 5,285% price rise in 2013, calling it an "epic, out-of-proportion" bull market.

Bitcoin recently set a 12-month high for the first time in at least a year.

The signal has historically indicated the end of bear markets and the start of new crypto bull markets. (Matrixport)

At the time of reporting, CoinCryptoUs data revealed that Bitcoin was exchanging hands at approximately $30,700.

Matrixport's perspective aligns with Bitcoin's historical pattern of experiencing significant upward trends within 12-18 months following a mining reward halving event. The upcoming fourth halving, scheduled for March/April next year, will reduce the block reward from 6.5 BTC to 3.25 BTC.

Bitcoin performance after previous "one-year high signal". (Matrixport)