NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

- Bitcoin (BTC) has witnessed a surge in support, rallying at the $30,000 mark.

- BTC open interest continues to rise, while funding rates remain in the positive territory.

Wednesday's early trading session in the U.S. revealed a growing sense of stability for bitcoin, as its price remained steady at $30,000. Additionally, the derivatives markets indicated a bullish sentiment, despite the resilient performance of BTC.

On Wednesday, Bitcoin experienced a lackluster trading day, continuing its trend of range-bound trading for the 12th consecutive day. Following a notable 22% price surge from June 15 to June 23, BTC prices have since declined by 1.3%.

Trading volume surged during the 9 a.m. (ET) hour on Wednesday when the U.S.-based markets opened. This increase coincided with a previous hour's drop to $30,349, accompanied by the Relative Strength Index (RSI) on the hourly chart falling below 30. This RSI reading indicated that BTC was oversold in the lower time frame.

Short-term intraday traders likely perceived the decline as a favorable chance to purchase BTC at a promising value. Conversely, investors with a longer-term perspective on bitcoin would be more inclined to consider BTC's RSI on a daily chart, where it currently stands at 62.

The RSI is a widely employed technical indicator that ranges from 0 - 100. A reading above 70 suggests that an asset is overvalued, while a reading below 30 indicates undervaluation. By utilizing the RSI across different time frames, it becomes possible to gain insights into the sentiment of traders with diverse time horizons or investment approaches.

Derivatives markets signal bullishness

Although spot BTC prices have stabilized, investors seeking exposure through derivatives markets seem to be placing their bets on upward price movements.

The open interest for bitcoin futures has surged to over $12 billion, compared to $10.4 billion at the start of June. According to On-Chain Analytics firm Glassnode, the open interest had peaked at $13.4 billion on June 29.

The volume of futures has been erratic, lacking a clear trend in either direction. However, the latest figure of $19 billion does not suggest a significant drop in activity.

Increasing open interest combined with rising prices frequently indicates investor optimism.

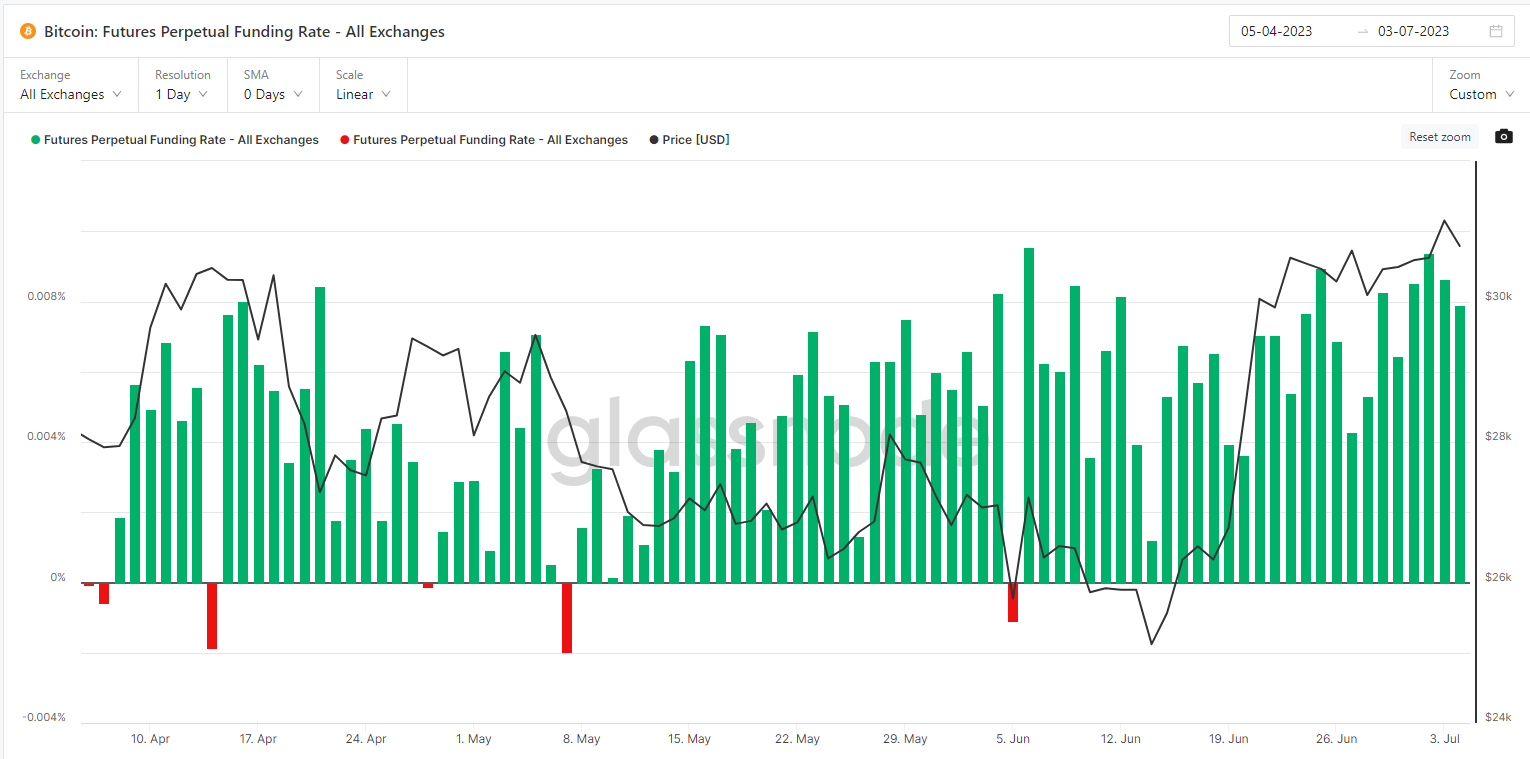

Bitcoin funding rates have remained positive for a continuous period of 29 days, with only one exception since May 11.

Funding rates serve as regular payments exchanged between traders holding either long or short positions in futures markets. Positive funding rates indicate that traders with long positions are willing to pay a funding rate to traders with short positions, signaling a bullish sentiment.