NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Binance Supercharges Bitcoin and Ether Trading in Argentine, Brazilian, and South African Currencies with Exciting Fee Promotion

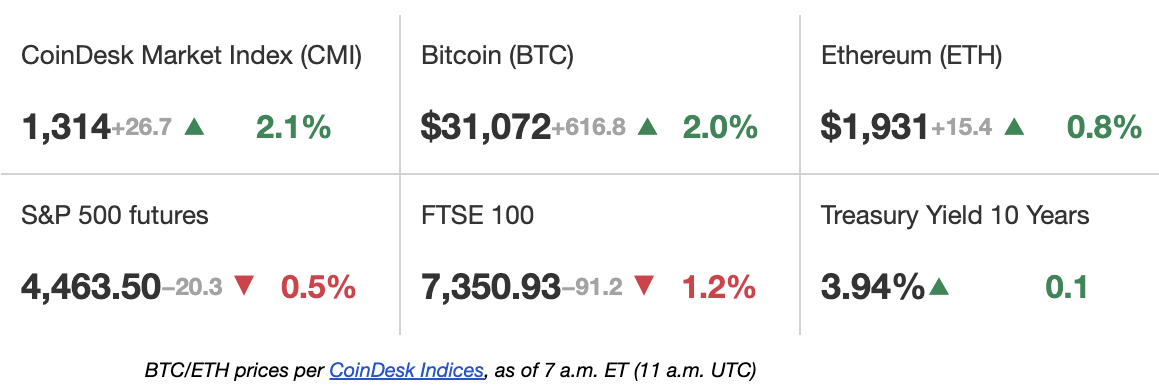

Latest Prices

Top Stories

Bitcoin (BTC) surged to a fresh 13-month high surpassing $31,500 in the early hours of Thursday morning, but later experienced a pullback to its current price of $31,100, marking a gain of over 2% for the day. Although the world's largest cryptocurrency had been trading above $30,000 for a couple of weeks, it faced difficulties in breaching the $32,000 level. Edward Moya, a senior analyst at Oanda, stated, "For the bitcoin rally to continue, we will need to get confirmation that the SEC will grant permission for a spot-Bitcoin ETF in the U.S," Meanwhile, the standout performer among large-cap cryptocurrencies on Thursday was bitcoin cash (BCH), which surged more than 12%. This continued the significant upward trend it had been experiencing since its listing on EDX Markets, which is backed by Fidelity, Charles Schwab, and Citadel Securities. Historical data from TradingView suggests that gains in the crypto market could persist in July. In the same month last year, BCH witnessed a 34% rise, while BTC saw a 17% increase.

In an interview with Fox Business on Wednesday, Larry Fink, the CEO of BlackRock, expressed his belief that cryptocurrencies, particularly bitcoin, have the potential to revolutionize the financial system. “We do believe that if we can create more tokenization of assets and securities – that’s what bitcoin is – it could revolutionize finance,” he said. Previously known to be a skeptic of crypto, Fink years ago suggested fans of the asset class heavily used it for “illicit activities.” Fink continued: “Instead of investing in gold as a hedge against inflation, a hedge against the onerous problems of any one country, or the devaluation of your currency whatever country you’re in – let’s be clear, bitcoin is an international asset, it’s not based on any one currency and so it can represent an asset that people can play as an alternative.”

Circle is currently contemplating the issuance of a stablecoin in Japan, following the implementation of stablecoin regulations in the country on June 1. According to Jeremy Allaire, the co-founder and CEO of the payment services company, in an interview with CoinDesk Japan, he stated that if stablecoins gain more widespread adoption for cross-border trade, foreign currency transactions, and global commerce, Japan will emerge as an exceptionally significant market. Allaire further commended Japan's stablecoin bill, which positions the country among the pioneers in establishing a regulatory framework for the utilization of international stablecoins. He considers this development to be “the most important thing the government and the Financial Services Agency have done.”

Chart of the Day

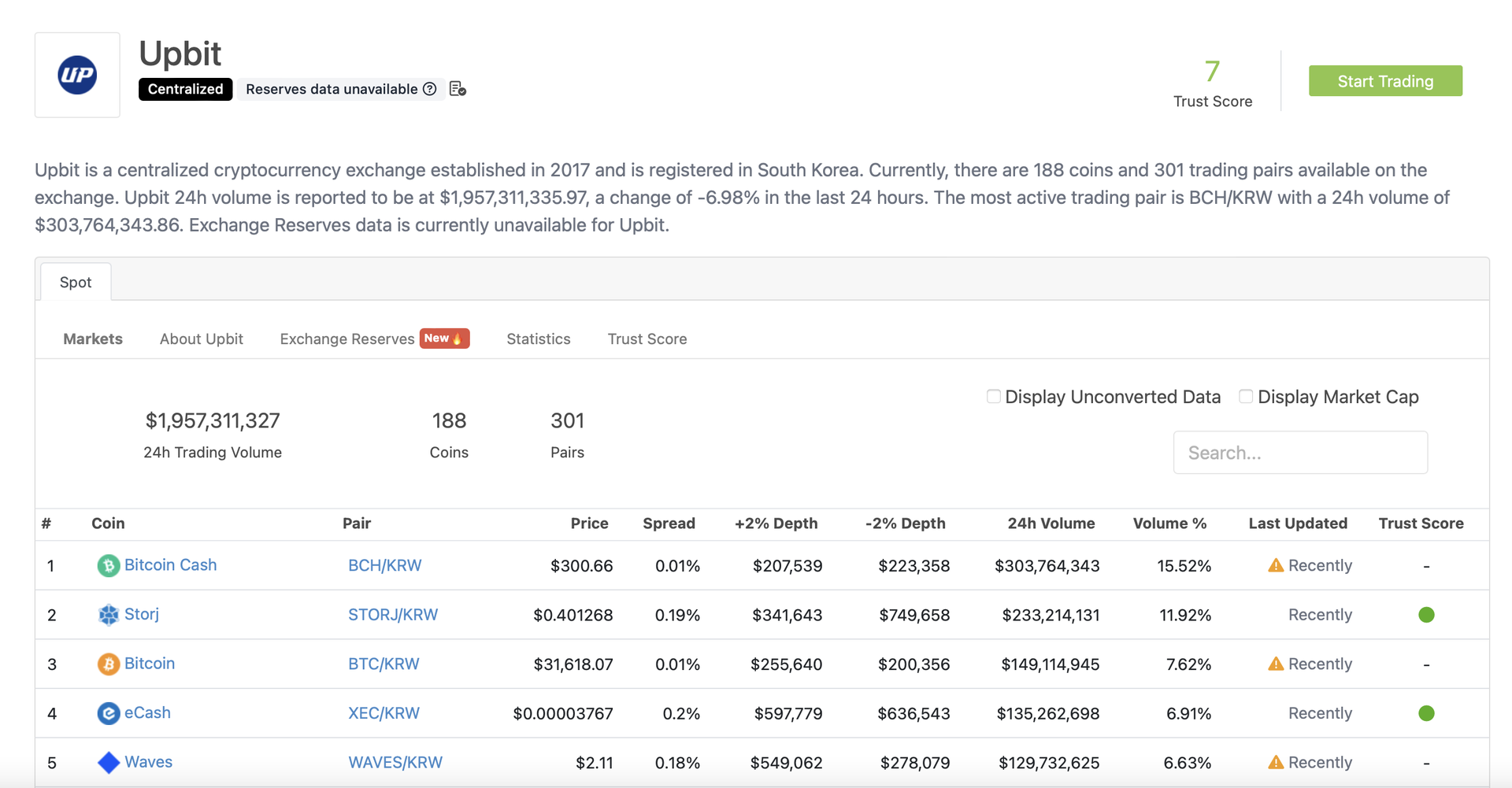

CoinGeko

- The chart displays the trading volume of cryptocurrency trading pairs listed on Upbit, the largest digital assets exchange in South Korea, over a 24-hour period.

- Over the past 24 hours, the trading volume of the bitcoin cash/Korean won (BCH/KRW) trading pair on Upbit has reached $303 million, marking a notable decrease compared to the $557 million recorded a week ago.

- Despite BCH's 12% increase in the last 24 hours, the prices are still considerably lower than the peak on June 30th and continue to fluctuate within the range of $250 to $320, which has been consistent since Korean trading volumes reached their highest point a week ago.

- "The Koreans have stopped buying BCH," highlighted Markus Thielen, Head of Research and Strategy at Matrixport, as he observed a notable decline in the BCH/KRW trading volume on Upbit.

Source Coindesk