SEC's Response to Challenge Groundbreaking XRP Ruling

U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

Coinbase's Pursuit of Regulatory Clarity Shapes its Global Expansion Strategy

Coinbase (COIN) and the Securities and Exchange Commission are poised to engage in a courtroom confrontation this week. Anticipation surrounds the upcoming hearing as it holds the promise of shedding light on the potential trajectory of the case, with the questions posed and the answers given offering valuable clues, at least for the present moment.

COIN flip

The narrative

Coinbase and the Securities and Exchange Commission are set to converge in court this week, offering a glimpse into the judge's early assessment of the case and potentially shedding light on its trajectory.

Why it matters

The trial has just commenced, and unless the parties reach a settlement, it is expected to prolong for several years (for reference, consider the ongoing SEC v. Ripple Labs case, now in its third year). Nonetheless, in an attempt to discern the future, the inquiries posed by Judge Katherine Polk Faila and the responses from the SEC and Coinbase attorneys will provide insights into the key matters that may emerge at the outset of this legal conflict.

Breaking it down

This Thursday marks the inaugural courtroom encounter between Coinbase and the U.S. Securities and Exchange Commission (SEC) as the federal regulator's legal action against the cryptocurrency exchange commences.

To quickly recap: In early June, Coinbase faced a lawsuit from the SEC, which accused the cryptocurrency trading platform of engaging in multiple roles simultaneously: acting as a broker, an exchange, and a clearinghouse for unregistered securities. The SEC specifically identified 13 different cryptocurrencies that it claimed met the criteria outlined in the Howey Test, a legal precedent established by the U.S. Supreme Court in the 1940s.

Coinbase has been hinting at the SEC lawsuit for several months, starting with a blog post they published upon receiving a Wells Notice from the regulatory authority. They have consistently pursued legal measures to argue that the current regulatory landscape lacks sufficient clarity for participants in the cryptocurrency industry to determine whether they are violating federal securities laws or not.

In its initial official response to the SEC last month, Coinbase persisted in its ongoing endeavor and contended that the SEC's actions not only infringed upon its due process rights but also attempted to preclude Congress by initiating a lawsuit.

Furthermore, Coinbase contended that the accusations should not be applicable to its operations.

“Like all securities, an economic arrangement can qualify as an investment contract only if it involves an ongoing business enterprise whose management owes enforceable obligations to investors. Absent such obligations, the contract is just an asset sale,” Coinbase argued. “Because no such obligations are carried in the transactions over Coinbase’s secondary market exchange, and because the value that Coinbase purchasers receive through these transactions inheres in the things bought and traded rather than in the businesses that generated them, the transactions are not securities transactions.”

The SEC remained unconvinced by this argument. In its response to the statement, the SEC stated, “Coinbase attempts to construct its own test for what constitutes an investment contract.”

The filing countered several key aspects of Coinbase's arguments, including their frequently reiterated claim that the SEC had the opportunity to assess the exchange's operations during their review of the company's documentation prior to its public offering.

From the regulator's perspective, the lawsuit is deemed appropriate, and furthermore, it highlights Coinbase's public disclosures as proof that the exchange has already acknowledged the likelihood of being sued.

The SEC expressed its dissatisfaction with certain filings made by Coinbase, deeming one of them as "improper," and requested the presiding judge to temporarily disregard it.

The pre-motion hearing is scheduled for this Thursday at 10:00 a.m. ET when the parties will convene in court.

This week

Tuesday

-

13:00 UTC (3:00 p.m. CEST) The European Union is set to formally publish its metaverse strategy.

Wednesday

-

06:00 UTC (7:00 a.m. BST) The Bank of England will publish its regular financial stability report.

-

18:00 UTC (2:00 p.m. EDT) The federal court overseeing Genesis Global Holdco’s bankruptcy will hold a hearing on voting procedures and whether or not its disclosure statement is sufficient.

Thursday

-

14:00 UTC (10:00 a.m. EDT) The federal court overseeing BlockFi’s bankruptcy will hold a hearing on its chapter 11 bankruptcy plan.

-

14:00 UTC (10:00 a.m. EDT) The federal court overseeing the SEC’s case against Coinbase will hold a hearing on Coinbase’s petition to file for a motion (see above).

Elsewhere:

- (Semafor) Twitter has issued a legal threat against Meta (previously known as Facebook) regarding its latest Threads product, indicating a potential lawsuit.

- (New York Times) The Times' Erin Griffith and David Yaffe-Bellany delved extensively into the connections between Tom Brady and FTX, along with other notable celebrities.

- (The Washington Post) GQ extensively revised and subsequently withdrew an article written by a freelance film critic regarding Warner Brothers Discovery CEO David Zaslav, the individual responsible for appointing Chris Licht to supervise CNN. The decision to withdraw the article was prompted by its perceived excessive criticism of the media executive, following a complaint from a spokesperson representing Zaslav.

- (Zero Day) The U.S. Securities and Exchange Commission has issued Wells Notices to SolarWinds, signaling the regulator's belief that it possesses sufficient evidence of misconduct to initiate legal action against the software company. Notably, the SEC has also sent notices to specific employees, including SolarWinds' chief information security officer.

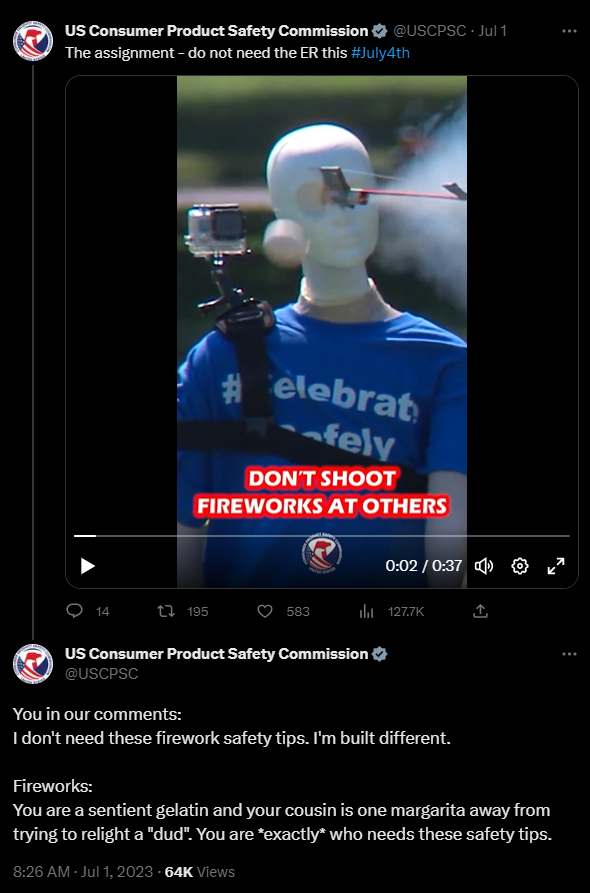

We are all sentient gelatin. (USCPSC/Twitter)

Source Coindesk