NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

Binance Supercharges Bitcoin and Ether Trading in Argentine, Brazilian, and South African Currencies with Exciting Fee Promotion

Bitcoin Approaches Formation of Death Cross as Dollar Index Hints at Golden Crossover

A staggering multi-million dollar exploit targeting the stablecoin-focused decentralized exchange (DEX) Curve Finance has prompted traders to swiftly shift their focus towards Uniswap's UNI token, seeking a safer alternative.

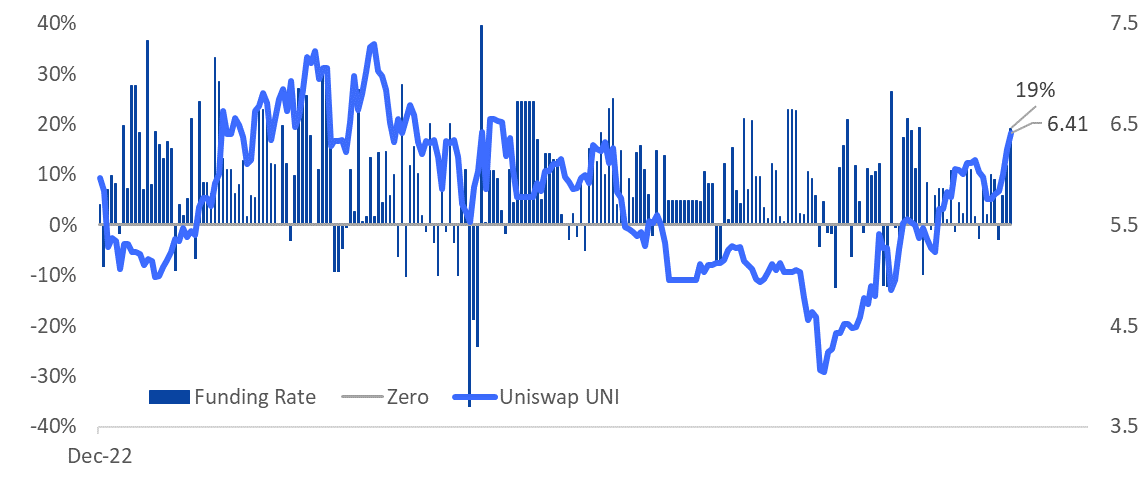

Following the exploit, funding rates in perpetual futures linked to UNI have skyrocketed to an annualized rate of 19%, as reported by crypto services provider Matrixport.

A positive funding rate indicates that the perpetual contract's price is trading at a premium to the mark price, which represents the estimated true value of the contract, a practice known as "marking-to-market." Positive rates also signify that longs or traders holding leveraged buy positions are prevailing and willing to pay funding to shorts in order to maintain their positions open.

"The UNI token [perpetuals] trades at a nearly 20% premium as traders expect Uniswap to gain even more market share after the CRV exploit," Markus Thielen, head of research and strategy at Matrixport, said in an email.

Funding rates have jumped to an annualized 19%. (Matrixport)

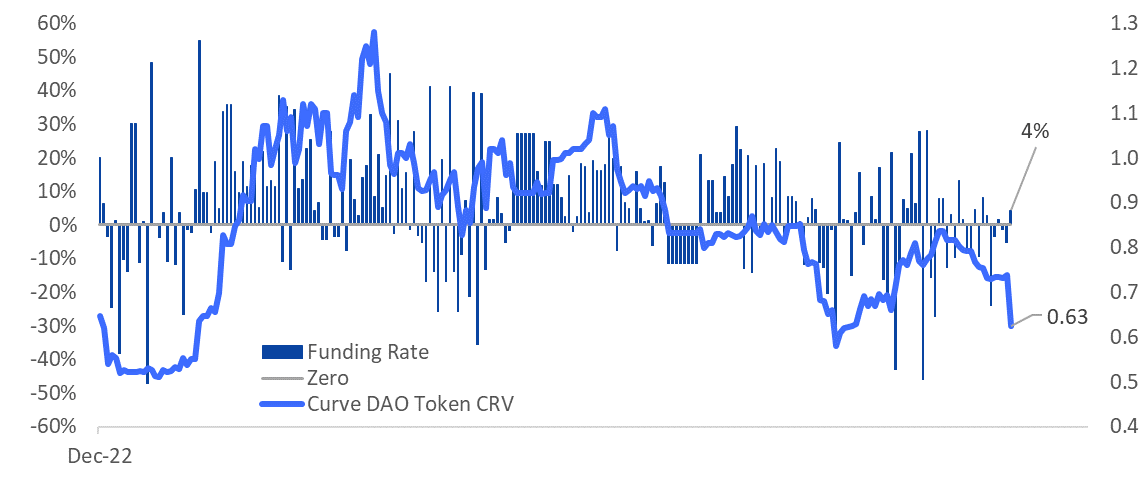

On a fateful Sunday, Curve, the third-largest decentralized exchange (DEX), experienced a harrowing flash loan exploit, jeopardizing a staggering $100 million worth of cryptocurrencies. In the aftermath of the attack, the value of Curve DAO's native CRV token plummeted by more than 15%, reaching a mere $0.63. This swift decline not only intensified the existing risks but also posed a significant threat of liquidating a borrowed position worth $70 million belonging to the founder of Curve.

However, despite the situation, the perpetual futures market shows no signs of panic, as funding rates in CRV and AAVE markets remain consistently above zero.

Funding rates in CRV perpetual futures remain positive after the exploit. (Matrixport)

"CRV DAO perp futures are still trading at a small premium, indicating that traders are more focused on moving positions away from the DEX (regarding TVL) rather than shorting the token," Thielen said.

After the hack, the total value locked (TVL) in Curve Finance experienced a significant drop, plummeting from $3.2 billion to $1.8 billion, as reported by the data source DeFiLlama. Conversely, Uniswap managed to maintain a steady TVL of approximately $3.8 billion, while AAVE's TVL declined from $5.85 billion to $5.37 billion.