MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

Binance Supercharges Bitcoin and Ether Trading in Argentine, Brazilian, and South African Currencies with Exciting Fee Promotion

Crypto exchange Binance is potentially facing fraud charges from the U.S. Department of Justice, as per sources familiar with the matter cited by Semafor. However, prosecutors are currently considering alternative actions due to concerns about the possibility of a bank run similar to what was witnessed with FTX.

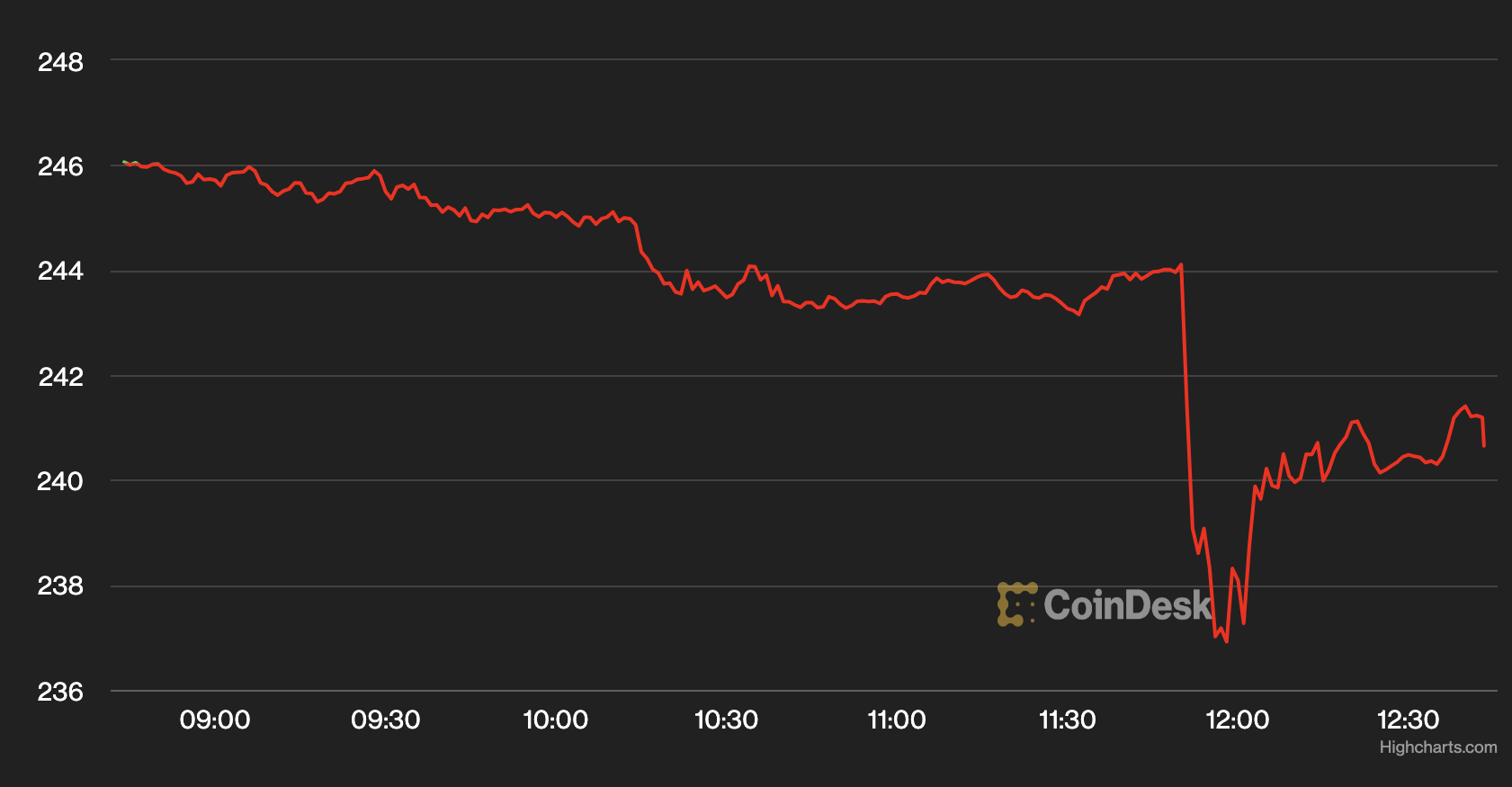

Immediately after the report, both Bitcoin (BTC) and Binance's BNB token experienced a sharp decline in their prices.

Binance's BNB fell after the Semafor report (CoinDesk)

Semafor reported that U.S. officials are expressing concerns that an indictment could pose risks to the entire cryptocurrency industry. To address this issue, they are considering alternative measures such as "imposing fines" or entering into "deferred or non-prosecution agreements," as stated by reliable sources.

Binance chose not to provide a comment, while the Justice Department did not respond promptly to CoinDesk's request for comment.

Prior to this, there was already widespread awareness that U.S. authorities were closely examining Binance. In a previous incident earlier this year, the Commodity Futures Trading Commission (CFTC) took legal action against the company and its founder and CEO, Changpeng "CZ" Zhao, citing deliberate evasion of U.S. regulations.

However, the agony inflicted by the FTX collapse last year, along with the well-documented history in traditional finance of collapsed firms such as Lehman Brothers in 2008, adversely affecting the entire industry, vividly demonstrates the peril associated with targeting a systemically important institution. Binance currently holds the position as the world's largest cryptocurrency exchange.

FTX's collapse wiped out billions of dollars in value from the cryptocurrency markets, sullied the industry's reputation, and forced Genesis, a major lending enterprise owned by Digital Currency Group (just like CoinDesk), into bankruptcy proceedings.

Source Coindesk