NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

- Bitcoin's price tumbles following a report stating that officials from the DOJ express worries about a potential rush on exchanges in case criminal allegations are brought against Binance.

- Before that story, cryptocurrencies had not witnessed a significant boost despite Fitch's downgrade of the U.S. credit rating on Tuesday evening.

- Previously robust positive correlations between bitcoin and stocks have disappeared, giving way to negative associations.

After the Fitch's downgrade of the U.S. credit rating yesterday, the expected rebound for bitcoin (BTC) didn't materialize. Instead, on Wednesday afternoon, bitcoin experienced a sharp decline in value due to a Semafor report that highlighted the concerns of U.S. Department of Justice (DOJ) officials regarding potential repercussions from the charges against Binance, a prominent cryptocurrency exchange.

Bitcoin experienced a slight decline of over 1%, dropping below $29,000 shortly after the news was released. However, a modest rebound has since occurred, pushing the price back up to $29,100, representing a 0.3% decrease over the last 24 hours.

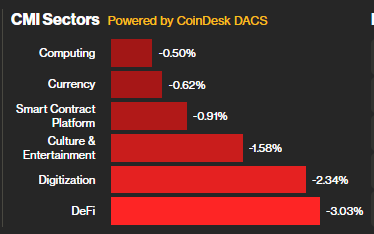

The CoinDesk Market Indices (CMI) also experienced a downturn, with various sectors showing negative performance. The overall CMI declined by 1%, with the Digitization Sector experiencing a significant drop of 2.3%, and the DeFi sector performing even worse, down by 3%. On the brighter side, the Computing Sector fared relatively well, with a modest decrease of just 0.50%.

Traditional markets are experiencing significant declines in the wake of the Fitch downgrade, with the Nasdaq leading the losses with a sharp decline of 2.3%. Another concern in the traditional finance sector is the consistently robust employment situation, as evidenced by the recent ADP jobs report for June, which revealed an impressive addition of 324,000 jobs, nearly double what economists had forecasted. This positive employment data has contributed to a notable increase of five basis points in the 10-year Treasury yield, which now stands at 4.08%.

The primary factors leading to Fitch's rating downgrade were anticipated fiscal deterioration, a mounting U.S. debt burden, and a decline in governance compared to peer countries.

The news about Binance emerged during a time when only a few factors had the ability to significantly impact the price of Bitcoin. Analyzing BTC's hourly chart reveals that the potential charges faced by the troubled exchange had a profound effect. Subsequently, Bitcoin experienced a sharp decline with higher than average trading volume after the report was released. Although prices have slightly recovered since then, the trading volume remains lower.

As expected, Binance's native token, BNB Coin, experienced a more significant downward movement, plummeting up to 4% with a surge in trading volume that surpassed the average.

As cryptocurrencies and traditional financial (tradfi) markets grappled with their respective bearish catalysts, their interplay has undergone a noteworthy transformation. What was a robust correlation between the two last year has, at one point this year, shifted to a minimal correlation, and currently, it has evolved into an inverse correlation.

Correlation coefficients lie within the range of 1 to -1, where a value of 1 indicates a direct positive relationship, and -1 implies a direct negative relationship. The correlation between BTC and the S&P 500 has decreased to -0.70, while its correlation with the DJIA has dropped even further to -0.85. Particularly noteworthy is the declining correlation of bitcoin with the U.S. dollar, currently standing at -0.82 compared to 0.03 on July 23.

Although the decrease in correlations with TradFi is noteworthy, it is essential to bear in mind that the gauge can be highly volatile. The coefficient has fluctuated from a peak of 0.91 to a nadir of -0.70 in the past year.