Ripple's Acquisition of Crypto-Focused Chartered Trust Company Fortress Trust

SEC's Response to Challenge Groundbreaking XRP Ruling

U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

- A federal judge has rejected Terraform Labs' motion to dismiss a lawsuit filed by the SEC.

- The judge further emphasized his rejection of relying on a previous ruling by another judge, which had determined that Ripple's sale of XRP to retail investors through an exchange intermediary did not violate securities law.

On Monday, a federal judge rejected the motion to dismiss the lawsuit filed by the U.S. Securities and Exchange Commission (SEC) against stablecoin issuer Terraform Labs. The judge stated that the SEC's arguments regarding jurisdiction were compelling and that the regulatory agency has presented a plausible claim suggesting potential violations of securities law by TerraUSD (UST), the Anchor Protocol, and LUNA.

Perhaps more significant is the rejection by Judge Jed Rakoff, presiding over the U.S. District Court for the Southern District of New York, of the ruling from fellow Judge Analisa Torres. Judge Torres had recently ruled in favor of Ripple Labs, stating that they did not violate securities law when they made XRP available on secondary platforms for retail investors to buy.

Earlier this year, the SEC filed a lawsuit against Terraform and its founder, Do Kwon, accusing them of deceiving investors about UST, a stablecoin tied to the U.S. dollar through the LUNA token, and engaging in fraudulent activities.

Terraform presented a motion to dismiss, contending that individuals acquired UST tokens primarily for practical usage and lacked the expectation of treating it as an investment. Additionally, the defense lawyers for Terraform referred to a precedent set by the recent Ripple ruling. In that case, Judge Torres asserted that although Ripple had violated securities laws by selling XRP to institutional investors, retail investors could not have been aware that they were purchasing XRP directly from Ripple. This was due to the fact that these retail investors acquired the token through intermediary exchanges as part of Ripple's programmatic sales.

In his Monday ruling, Judge Rakoff stated that he firmly rejected the proposed approach.

"Whatever expectation of profit they had could not, according to that court, be ascribed to defendants’ efforts," he wrote. "But Howey makes no such distinction between purchasers. And it makes good sense that it did not. That a purchaser bought the coins directly from the defendants or, instead, in a secondary resale transaction has no impact on whether a reasonable individual would objectively view the defendants’ actions and statements as evincing a promise of profits based on their efforts."

The SEC has already suggested its intention to contest the verdict.

During the motion to dismiss stage, the facts in the SEC's complaint must be assumed to be true, he noted, and the SEC said in its filing that Terraform had "embarked on a public campaign to encourage both retail and institutional investors" to buy UST.

Furthermore, the judge dismissed Terraform Labs' objection based on the "major questions doctrine," a legal principle that originates from a Supreme Court ruling. This doctrine effectively prevents regulatory agencies from exceeding their authority significantly. Several cryptocurrency defendants, including the prominent crypto exchange Coinbase, have utilized this argument to challenge the SEC's actions. Nonetheless, the judge found this objection untenable.

"As the doctrine’s name suggests and the Supreme Court has, in case after case, emphasized, the Major Questions Doctrine is intended to apply only in extraordinary circumstances involving industries of 'vast economic and political significance,'" he wrote. "This question, moreover, of whether an industry subject to regulation is of 'vast economic and political significance' should not be resolved in a vacuum. Rather, an industry can be considered to have 'vast economic and political significance' only if it resembles, in these two qualities, the industries that the Supreme Court has previously said meet this definition."

He expressed that the cryptocurrency industry 'falls far short' this benchmark," he wrote

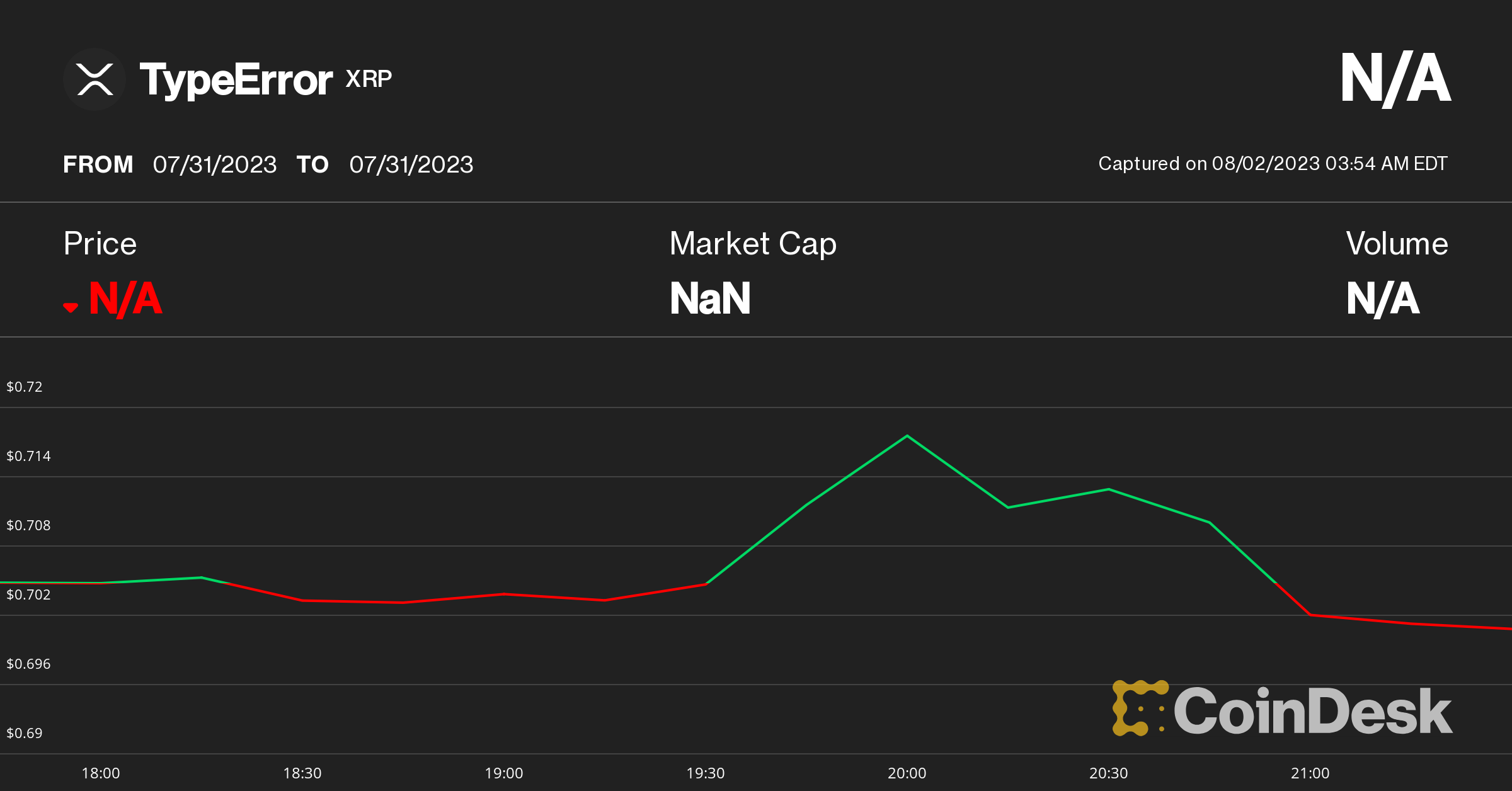

The publication of the ruling resulted in approximately a 2% decline in the price of XRP, with the cryptocurrency dropping to as low as $0.69 from an intraday high of $0.72. At the time of press, it was trading around $0.70.