Axie Infinity's Token Soars 12% Following Game's Listing on Apple App Store

For the ETH Merge, FTX will halt Ethereum trades on Arbitrum, Solana, and BSC

GameFi developers may be subject to significant fines and harsh punishment

Twitter says that StarSharks is once again the best game on BSC. StarSharks has a lot more transactions and WAU than Mobox and Bomb Crypto did in the past.

Because this game looks a lot like Axie Infinity, it's become one of the hottest games today.

To find out more about StarSharks, read the text below:

StarSharks is a BSC-based metaverse game that is all about shark NFTs. Players use different kinds and levels of sharks to complete different game tasks.

It was started in December 2021 by a group of people who had played traditional games before. It's not just a GameFi project. It's called ContentFi, and it places a lot of emphasis on content, looks for NFT applications, and adds value for users.

aaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaa

There are a lot of things that make StarSharks different from other sharks.

A player must have three NFT sharks to start their journey in StarSharks, and if they burn two of them, they can make a higher-level one. Players get SEA tokens for killing all of the sharks in PVP or PVE, and extra SSS tokens if they finish in the top 500 in PVP each season.

StarSharks has more things to do and see than a lot of other GameFi projects.

Leasing is built in.

At 500 Sea (about $200), you can buy a blind box of sharks. On the market, you can buy for about 0.341 BNB (about $150). It doesn't matter what kind of shark the player chooses, he has to spend at least $450.

This means that StarSharks has a built-in leasing system that makes it easier for people to get to the platform. As a result, lessors make extra money because the platform cuts down on the minting of NFTs.

If you want to rent three sharks, you'll pay about 4 to 5 SEA for each one. About 37 SEA can be made by three one-level sharks each day. Players who rent sharks need to think about the balance between the rental price and the money they make.

Invite people to share in the profits.

When the platform has an invitation mechanism, it makes it easier for guilds and people to get more people to join them. SSS tokens will be set aside for the top 500 referrals to show them how much they helped out.

Because of a vote that took place on March 31, only StarSharks affiliates were allowed to make invitation links for VeSSS holders, so they could be rewarded.

Tokenomics and data are two things that go together.

StarSharks has two tokens: SSS, which is used to run the game, and SEA, which is used in the game.

SSS

SSS is the governance token, and there are 100 million of them. For Collect to Earn, 61 percent of this money will have to be used up in the next 10 years, with 15 percent of this money going to Collect To Earn's team. This money will also go to the company's reserve fund, the market fund, the angel fund, the private round, and the liquidity pool.

The value of SSS is kept stable by a "releasing-staking-recycling" system on the platform.

In terms of how much SSS is released each year, there is an annual decay factor.

To be able to vote on community governance, players need to stake SSS. They get a share of the profits, and this makes it less likely that SSS will be sold.

By locking up SSS for different lengths of time, users can get a different amount of VeSSS. The maximum lock-up time of 4 years is 1:1 for users who get VeSSS, so they get the same amount.

People who own VeSSS get a share of a bonus each week based on how many shares they own. It comes from 70% of the 4.25 percent trading fee on NFT and 30% of the SSS that is paid when NFT is made.

According to the model, the recovery rate (SSS used in the year / SSS released in the year) needs to be 20% to keep the platform strong.

SEA

SEA is an in-game token that can be made at any time. The platform balances production and consumption to keep the value of the token stable. Players can only get the SEAs in the game. They can't get them outside of the game.

Users can only use SEA if they buy the Shark blind box, which makes it possible for SEA to be used. You also get Sea things when you play games. This setup makes it easier for people who buy NFTs to figure out how long it will take them to earn back the money they spent on them. It takes about 40 to 60 days to earn back the first 1500 SEA that they bought.

It will take a small amount of the 500 SEA that players pay when they mint sharks to pay for the handling fee. The majority of the money will be burned and the rest will go to the referrer. The money the SEA spent on the shark upgrade will also be burned, which shows that the SEA is trying to keep prices from going up.

It's important to note that people who sell NFTs get BNB instead of SEA, which reduces the selling pressure on SEAs.

A look at the whole thing.

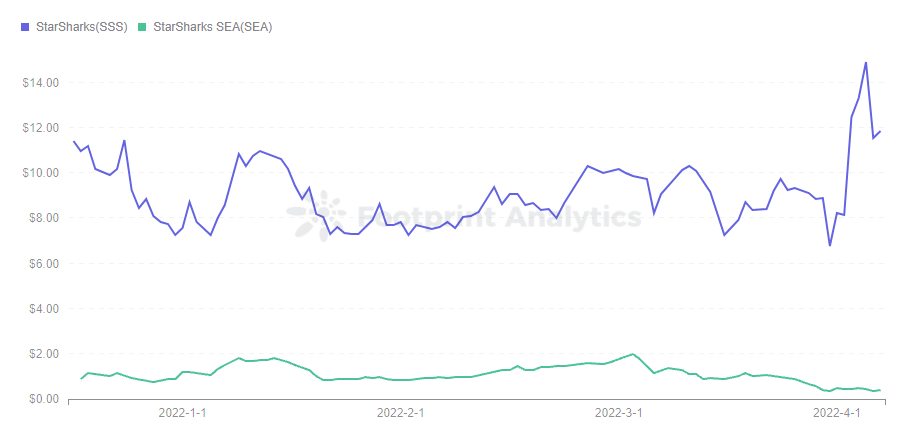

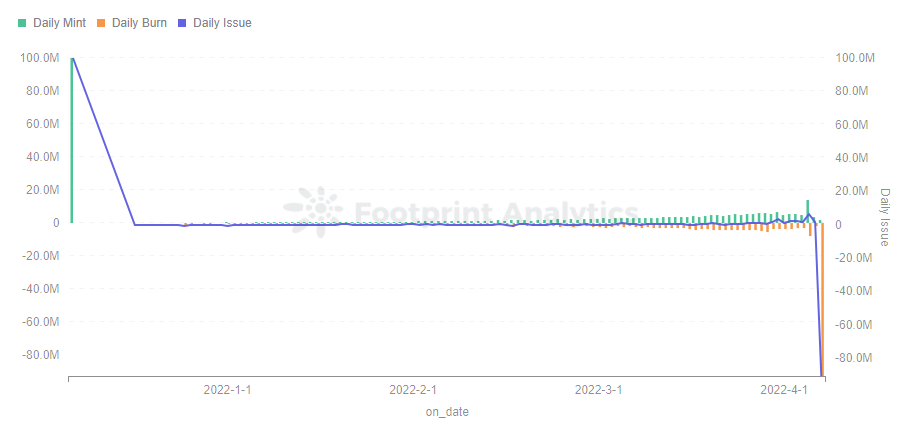

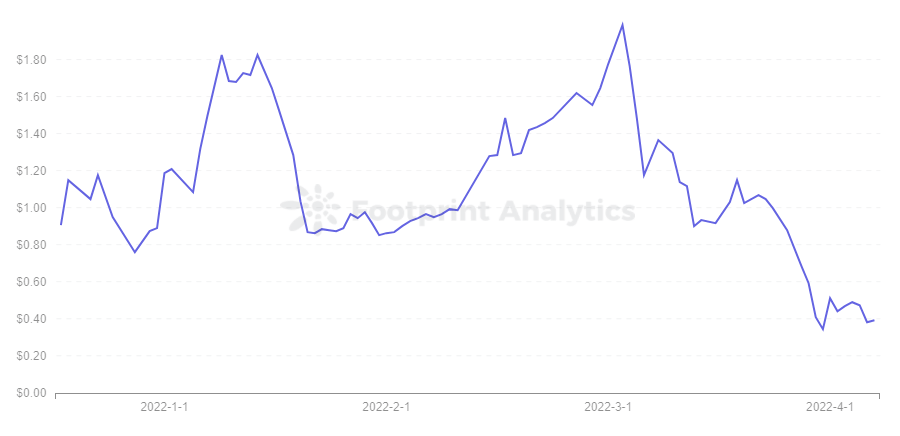

Looking at the data from Footprint Analytics, SSS and SEA have stayed about the same price. There is more selling pressure on the in-game token SEA, which has dropped below $1 and is now worth less than 10 cents.

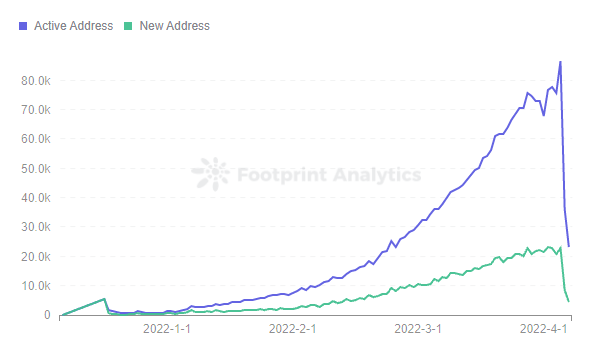

As you look at the token trend, StarSharks has been getting more users, but the burning model hasn't been able to stop it.

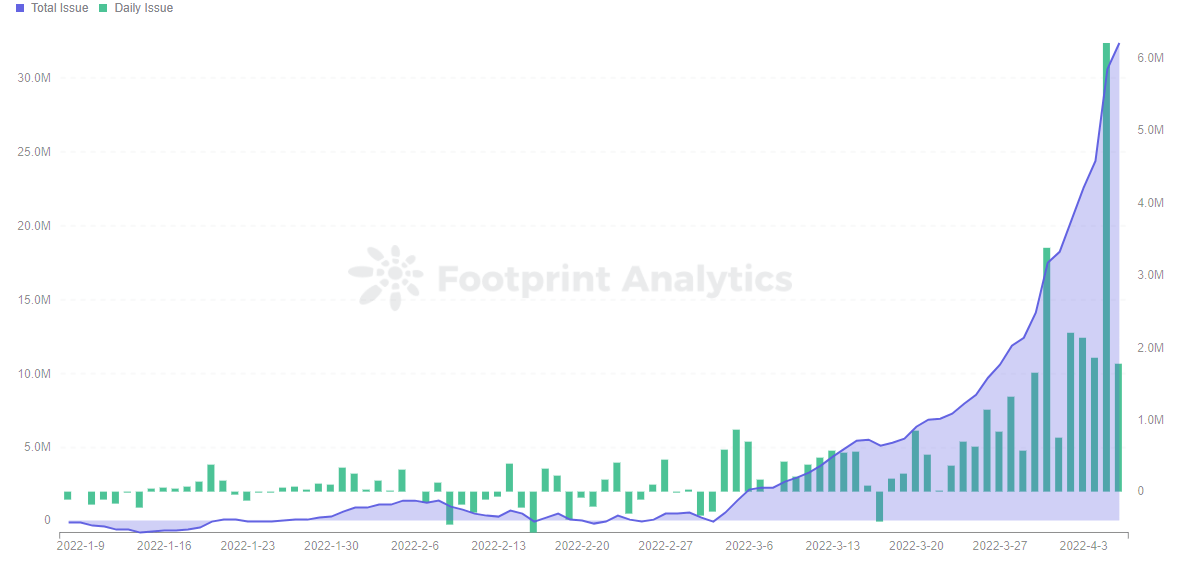

This is because more people are using the game, which has led to more SEA being made. In the game, players can also make money by renting things. This has changed the amount of SEA that people use to buy blind boxes.

Early on, the daily SEA net issuance was mostly negative because there were not enough NFTs for users, so they bought more blind boxes. As the program grows, more people join, the number of NFTs for rent grows, and net SEA issuance rises in the later stages.

After March, the cumulative issue turned positive and quickly rose, so the SEA's burning rate couldn't keep up with the minting, which caused SEA's prices to go up, too.

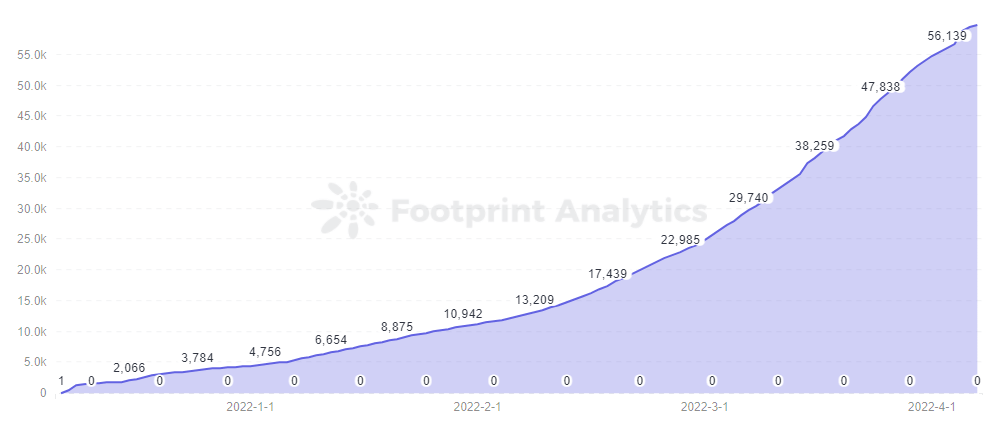

It's hard for new people to join GameFi projects if the token price keeps going down. This means that less people will join. The project could go down in flames. The game's life cycle is shown by how many people play and how much tokens cost.

With the end of the scholarship event on April 1, new and active users dropped off, and the token price also started to fall. The project saw this and quickly made a series of changes.

It started on April 6 and 7 when the game mechanics were changed. These changes included canceling daily tasks and slot machines, increasing the number of tokens needed to upgrade, increasing the limit on how many SEAs you can claim, and widening the output difference between shark levels.

These measures show that the team is paying attention to how much SEA is being made and circulated, and how much SEA is being burned. After the 6th, Footprint Analytics saw a big drop in the number of people who used SEA every day and bought it.

All of the team has earned so far is 91.43 million SEA. On the 7th, they burned 91.43 million SEA. All of these moves show StarSharks' efforts to make the price of SEA go up, which is why they made them. In spite of this, the price of SEA hasn't gone up very much since April 8.

Even though the value of SEA didn't change, SSS rose very quickly after April 1 when everyone had been able to vote on the StarSharks affiliate program. The proposal made it only possible for stakers with more than 10,000 VeSSS to make invite links, which made clear how SSS could be used.

Is the future of StarSharks good?

In the five months since StarSharks first came out, the number of people who play the game has grown by a lot. Because of this, the price of the tokens has dropped because there was a mismatch in how many tokens were made and burned.

Even though the project has learned from its predecessors and quickly adjusted to the token economy, it still didn't know how to stop its decline. If they can't control the token price, new users will fall into a death spiral.

They also show that StarSharks is going to be around for a long time by working hard on game design, making changes quickly, and burning a lot of money.