GameFi developers may be subject to significant fines and harsh punishment

A significant hack of play-to-earn cryptocurrency games is imminent

India leads the world in NFT gaming, whereas Western countries have fewer P2E players

Are innocent fun cryptocurrency games? Or are they Ponzi scams that American officials are about to crack down on?

As of mid-August, give or take a few billion, the cumulative value of "GameFi" tokens, which are used in cryptocurrency games, was close to $10 billion. (The figure may change depending on whether you want to count partially completed projects, how many tokens are actually in circulation for each project, etc.) In that sense, the legality of the games is a $10 billion issue that few investors have thought about. And that's a mistake they might come to regret.

That's because there seems to be a growing bipartisan consensus among American legislators that the sector ought to be shut down. There are at least two bipartisan ideas floating among senators that would effectively evict these gaming enterprises from American land, though they haven't expressly addressed the issue (good luck finding a member of Congress who has used the word "GameFi").

Senators Cynthia Lummis (Republican from Wyoming) and Kirsten Gillibrand (Democrat from New York) introduced the Responsible Financial Innovation Act in June, which, in Lummis' words, would classify a "majority" of cryptocurrencies as securities subject to regulation by the Securities and Exchange Commission (SEC). Additionally, this month, the Digital Commodities Consumer Protection Act was proposed by Senators Debbie Stabenow, a Democrat from Michigan, and John Boozman, a Republican from Arkansas. Similar results would result from designating Ethereum as a commodity, putting it under the control of the less intrusive Commodities Futures Trading Commission (CFTC).

Securities classification for Axie Infinity, DeFi Kingdoms and other games

Any token in which investors make investments with "an expectation of profit," as per the SEC definition that Congress seeks to confirm, is likely to be a security. Let's discuss what it would imply for your preferred tokens.

One reason is that this definition is probably going to cover initiatives that encourage liquidity pools. Axie Infinity, which rewards liquidity pools with interest payments made through its native token, AXS, and DeFi Kingdoms (DFK), which rewards liquidity pools with its native tokens, JEWEL and CRYSTAL, are two examples of projects this would impact.

Why are liquidity pools significant? Merav Ozair, a blockchain expert and fintech professor at Rutgers Business School, stated in an interview last month that users are "seeing it as an investment" as a result. "That's not a security if it's a token used to purchase in-game objects. However, the token has a different use case if you can use it to invest in equities, she explained.

The concept is also probably going to cause issues for projects that have benefited from private token sales, ICOs, or the sale of non-fungible tokens (NFTs). This includes DFK, which sold more than 2,000 "Generation 0" characters to launch its game last year, as well as Axie, which sold 15% of the total supply of AXS in pre-game or private token sales.

They "come under the definition of a security if they are using [anything] to produce capital," according to Ozair.

In addition to the obvious, history suggests that SEC prosecutors will certainly uncover a variety of other justifications for classifying gaming tokens as securities. The government claimed in a lawsuit filed last month that certain tokens offered on Coinbase were securities because of anything from developers referring to investors as "shareholders" to one project's choice to display a headshot of its CEO pointing at a joke about Goldman Sachs.

Consequences: Fines, Registration & Disclosures

Depending on how lenient SEC authorities are feeling, the penalties that game producers could receive could differ. Developers will, at the very least, be obligated to abide by the same disclosure regulations as American public firms. This entails reporting public officers, principal stockholders (i.e., those who own more than 10% of the total supply of tokens), and an annual report that contains an audited financial statement and cash flows.

For many developers who have grown accustomed to managing projects worth millions, and occasionally billions, without disclosing their names, the disclosure requirements alone could be an unpleasant shock. A securities classification would probably result in significant fines for contravening projects, which is more significant.

The SEC reached a settlement this month with a project that participated in an ICO while failing to register its offering as a security, which may be a sign of how regulators may approach the problem. Developers in that case consented to file with the SEC and provide payments to investors for alleged losses, or risk a fine of up to $30.9 million.

Christos Makridis, a specialist in tokenomics and adjunct associate research scholar at Columbia Business School, said in an interview with Cointelegraph that "intent matters." Some NFT and GameFi projects are so complicated that the rules are obviously being avoided.

Nevertheless, he added, "If you consider the role tokens might play in gamifying education, an overly rigorous and narrow definition is going to eliminate a lot of value-creating enterprises and prevent many entrepreneurs from building in the U.S.

Alabama, Hawaii, Utah, and 47 other states may want to have a word

For troubled crypto game fans, regulation out of Washington, D.C. is just one obstacle on the horizon. What the late U.S. Defense Secretary Donald Rumsfeld referred to as "unknown unknowns" are the cause of a less predictable problem.

Alabama, Hawaii, and Utah are an unusual trio of U.S. states that serve as this example. (If you're keeping score, Canada is also included on this list.) Raffles, which have grown incredibly popular in the area of cryptocurrency gaming, are generally prohibited by each jurisdiction.

For instance, between January and February of this year, Axie ran a lottery that promised participants the chance to win a variety of NFTs if they "released" (that is, burned or destroyed) their characters. DFK quickly adopted a similar strategy, requesting that players wager on the possibility of losing their characters in March in exchange for the chance to acquire better (and more expensive) "Generation 0" characters. In recent months, smaller raffles have proliferated throughout DFK, with chances to take part in both daily and weekly competitions, among others.

According to experts, the raffles are problematic for American authorities even outside of the three states where they are categorically forbidden.

According to David Klein, managing partner of the New York-based law firm Klein Moynihan Turco LLP, "what they need to do to set it up as a sweepstakes, which implies there is an alternate free method of entry that has an equal potential to win as those that pay to participate."

"If you have to ruin a $200 item to enter, that is consideration, if you have to put it on the line, "Klein tacked on. Unless there is a different, completely free manner of entering, such as mailing a postcard, contacting a 1-800 number, or visiting a website and filling out the necessary information.

There was yet more on the list of issues. A promise to distribute 800 "amulets" (an NFT that represents a piece of equipment) at random to players who held between about $1,000 and $50,000 in JEWEL tokens from December 15 to January 15 is one of several elements of DFK's lottery system that disgruntled players have long complained. The amulets were still unclaimed as of mid-August, seven months after the raffle's conclusion, despite assurances from the creators that the machinery was still in the works.

There are numerous issues there, "said Klein. "It's crucial to communicate when you have these competitions. The raffle's start date must be made public prior to the competition's opening. The contest regulations must be written and cannot be significantly altered. You must follow through on your promises to award awards when you say you would. Within a predetermined number of days, you must notify particular state governments of your winnings and provide them with a list of the winners. And if you don't, you're breaking those state laws.

Additionally, developers may have created additional regulatory or legal risks by expanding their projects internationally before gathering legal teams to assess potential risks.

Declining players, expanding token supplies, dropping prices

Developers have a more obvious issue than unexpected legal repercussions: a fast dwindling user base. Blockchain data compiled by DappRadar shows that the number of users interacting with Axie Infinity decreased by 95% from a peak of 744,190 on Nov. 26 to 35,420 on Aug. 20. A peak of 36,670 DFK gamers in December was followed by a decrease of 85% to 5,290 as of August 19.

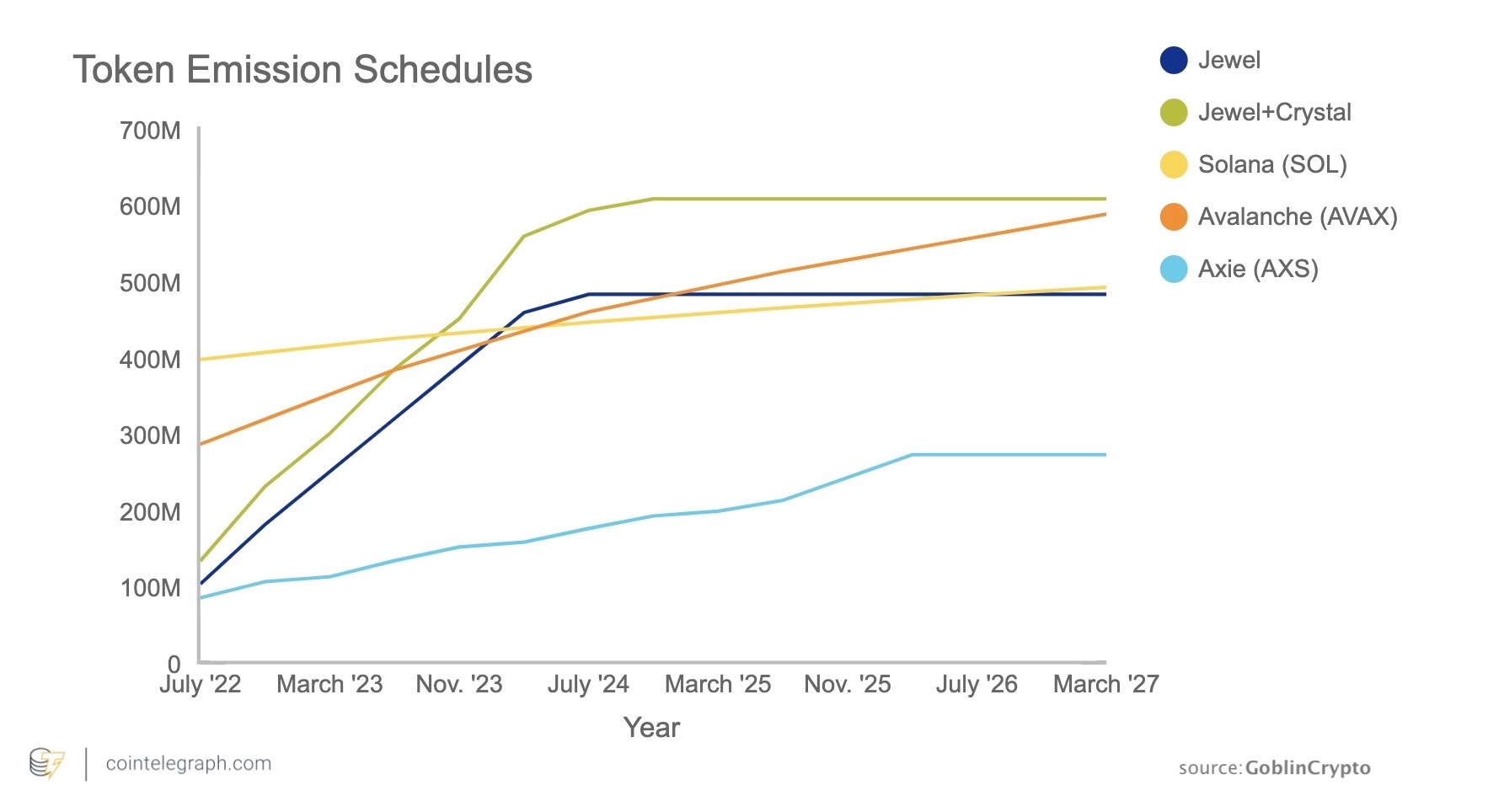

The decrease coincides with a sharp increase in the number of circulating tokens; over the same time period, DFK's JEWEL supply increased from about 60 million to more than 100 million. By the middle of 2024, the supply will have increased by 500% to 500 million, excluding a new token called CRYSTAL that was introduced when the game was launched on the Avalanche (AVAX) network.

Klein, who oversees compliance for a number of secret, high-profile NFT initiatives, evaded the question of how many years of harsh prison time developers would be facing for improperly conducted raffles. He remarked, "I want to help the industry do it right. However, he warned against being accused of breaking state gaming rules by a regulator, which is illegal, in regards to ventures that haven't complied. You can face a lawsuit from a disgruntled private litigant. or a mix of the aforementioned.

It appears that 80 million Axie Infinity tokens are currently in use, with a further 190 million set to be distributed over the following three and a half years. It is important to note that it appears that developers are fiddling with official circulation data, which could lead to further regulatory scrutiny in the future.

A problem that could deprive developers of legal funding when it's most required is the rapidly growing token supply coupled with a declining number of buyers.

Can devs do something?

By the middle of 2023, according to Lummis, Gillibrand, and other lawmakers, Congress will most likely approve legislation that clarifies the securities laws relating to cryptocurrencies. Where are the project's developers in light of the coming sea change? There has been no communication from the $10 billion sector. (Although their characters, land, or other NFTs are not included in this statistic; it only accounts for the value of tokens tied to gaming initiatives.)

According to CoinGecko's report, the developers behind the top 16 play-to-earn projects have revealed their identities. Of course, that includes anyone connected to Sky Mavis, the creator of Axie Infinity. However, the bulk, including those behind DFK, have chosen to maintain their anonymity and have revealed little about themselves, including their home nations. (To be fair, DFK did incorporate a business in Delaware this year called Kingdom Studios. An inquiry for comment was not answered by that organization.)

Realistically, if developers want to see congressional ideas changed, they have less than 365 days to start pressing lawmakers. They haven't made any radio noise so far. Every day that goes by in silence seems to increase the likelihood that GameFi investors will lose everything.

---------