Donald Trump Possesses Crypto Holdings Valued Up to $500K

Coinbase's Highly Anticipated New Core Blockchain Attracts Modest $10M Inflows Upon Launch

Innovative Bitcoin-Powered Arcade Game Makes a Lasting Impression on Gamers

Sept. 19 has recently been suggested as the possible target date for the Ethereum Merge following the completion of a third successful testnet merge. Proof-of-stake (PoS), a more energy-efficient consensus method than proof-of-work (PoW), the original consensus method employed by the Bitcoin network, is scheduled to completely replace PoW in Ethereum.

"The Merge alone won't address Ethereum's scaling issues. According to Lido's head of business development, Jacob Blish, "it is simply the beginning of a road map to achieve future scaling enhancements."

After the Merge is finished, it's anticipated that the staked Ether (ETH) on the Beacon Chain, the PoS network that replicates Ethereum transactions, would be locked up for at least six months. Following the Merge, transaction fees and the maximum extractable value will start to benefit staked ETH liquid tokens, increasing yields.

The Merge has generated a lot of buzz. The founder of Rocket Pool, Darren Langley, told Cointelegraph that it is the single biggest event in cryptocurrency in a very long time. He continued, "The lockup period is testing liquid staking protocols now, but this is mainly due to macro conditions and the ongoing Centralized Finance (CeFi) drama. The liquid staking will burst once it blows over.

According to StakingRewards, with just over 10% of the ETH supply being staked, ETH staking returns are currently generating close to a 4% annual percentage rate (APR).

Lido’s liquid staking service

The launch of the Beacon Chain created a need in the ecosystem for a decentralized liquid staking solution that would compete against centralized exchanges (CEX) and could be used within decentralized finance (DeFi) for lending, borrowing and more.

The staking service offered by Lido has gained popularity as the first protocol to implement a liquid staking derivative on Ethereum through the minting of the stETH token. Contrary to popular belief, stETH is not meant to be pegged to ETH. As Blish shared:

“Staked ETH issued by Lido is backed 1 to 1 ETH but the exchange rate isn’t pegged. It can fluctuate and trade at a premium or a discount as the secondary market forces dictate the price. This doesn’t affect the underlying backing of stETH.”

Lido has advanced with new DeFi integrations for stETH as well as other multichain-staked goods including Solana, Polygon, Polkadot, and Kusama thanks to its first-mover advantage in launching a liquid staking solution. In order to further their DeFi integrations, the team recently announced that stETH will expand to layer-2 solutions.

In order to forward its expansion strategy and establish itself as a temporary victor in the liquid staking market, the protocol used incentives in the form of additional awards in the Lido token (LDO) and a referral scheme to entice liquidity to the Curve pool.

Lido stands out among other protocols in the DeFi ecosystem as the only one that has been able to compete with and even outperform its centralized rivals, such as the Binance ETH (BETH) token, in terms of overall value locked.

Alternatives to liquid staking derivatives

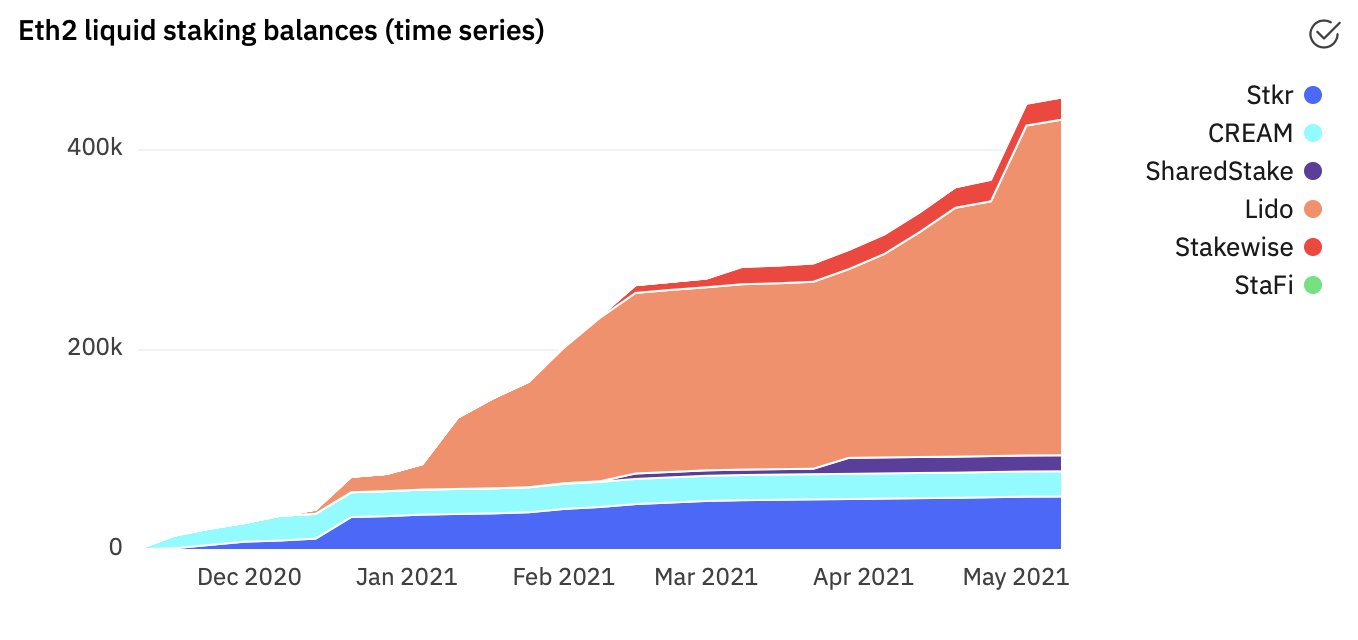

New products typically have strong market leaders at first, but as competition grows and new items are introduced, there is a chance for market share to be gained. It is difficult for Lido's rivals to catch up and take a sizable chunk of the market because of the network effect the company was able to accomplish in such a short amount of time.

The value proposition of other liquid staking initiatives varies slightly in terms of fees, product decentralization, and token features, but it is still to enable users to maximize capital efficiency and compound their profit while protecting the network.

The foundation of the Ethereum ecosystem is trustless decentralization. According to Jordan Tonani, head of institutions at Index Cooperative, "having a healthy competition between multiple liquid staking protocols is a better outcome, and shortly after the Merge, a new crop of liquid staking protocols will be propped up to promote decentralization. Having that much voting power in the hands of one organization is certainly counter to that ethos.

With 1,300 different node operators spread across 84 different locations, Rocket Pool represents more than 1.5% of all Ethereum staked. As a result, new scaling solutions could have an effect on Lido's market domination and increase its prominence in the liquid staking area.

Other initiatives like Stakehound, Stkr, and Stakewise are vying for Lido's market share but fall short in terms of liquidity depth and usefulness as collateral in DeFi.

In contrast to Lido's permissioned approach, Rocket Pool's permissionless strategy appears to be more decentralized at first glance. This was a trade-off made to guarantee the dependability of node operators during the protocol's early phases. To depart from their present strategy, the Lido team has been developing permissionless onboarding based on performance reputation.

Monopoly or oligopoly, it has to be decentralized

Based on the statistics, Lido presently controls the liquid staking derivative market, which is still in its infancy.

As a decentralized autonomous organization (DAO), Lido started a discussion on its governance forum about restricting stETH to a specific portion of all ETH staked. Blish clarified:

“We are aligned with Ethereum’s decentralization ethos at the core. Governing the protocol through a DAO ensures Lido will not pursue any actions that can enter into conflict with our community and values.”

Additionally, a dual token governance proposal that recently passed enables owners of stETH to veto LDO token holders' governance proposals that would hurt Ethereum network stakers.

Similar to the liquid staking conundrum mentioned above, mining Bitcoin (BTC) seems to be exhibiting centralizing forces. The market has developed to the point where the top three mining pools control more than half of the network's hash rate. Furthermore, according to data from BTC.com, the top six mining pools have contributed more than 80% over the past three months.

It is challenging to foresee the changes we will encounter following the Merge and the potential effects it may have on liquid staking products. Although liquid staking derivatives have a tendency to become more centralized, there may be a positive middle-term development as other alternative products acquire popularity and create an oligopoly.

The success of Ethereum, particularly its genuine neutrality, depends on maintaining a significant level of decentralization, according to Langley. "The key to decentralization is lowering barriers-to-entry, including lowering the collateral requirement and the technological obstacles," he added.

In the month after, some volatility is anticipated as the buzz about the Merge's liquid staking products continues to grow. Never before has there been a greater demand for these goods. If the market will be dominated by one, a few, or many liquid staking derivative products will be determined by future advancements.

---------