Trump's NFT Sales Netted Him Up to $1M, According to Filings

OpenSea Upgrades to Pro Level, Ralph Lauren Ventures into Crypto

Warner Music Group works with OpenSea to give artists more ways to make money on Web3

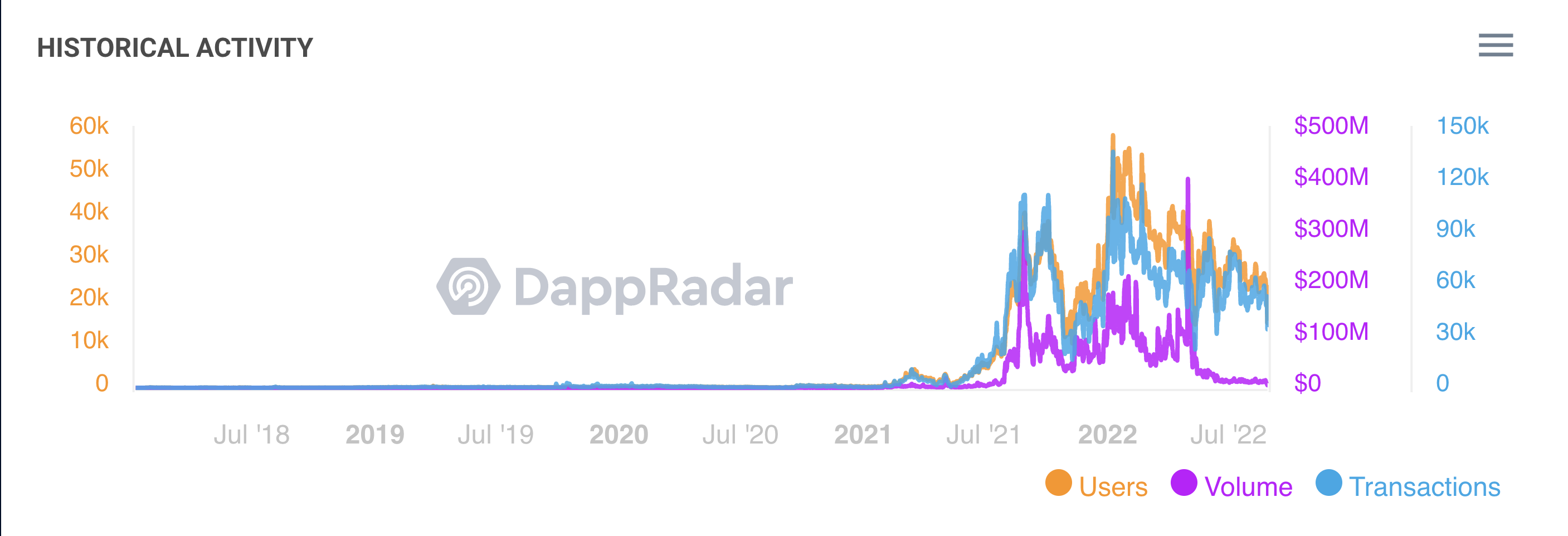

The daily volumes on OpenSea, the biggest nonfungible token (NFT) market in the world, have significantly decreased as concerns about a potential market bubble mount.

OpenSea volume plummets to yearly lows

Notably, the marketplace processed nearly $5 million worth of NFT transactions on Aug. 28 — approximately 99% lower than its record high of $405.75 million on May 1, according to DappRadar.

The sharp drops in OpenSea users and transactions coincided with sharp drops in daily volumes, indicating that value and interest in blockchain-based collectibles have declined recently.

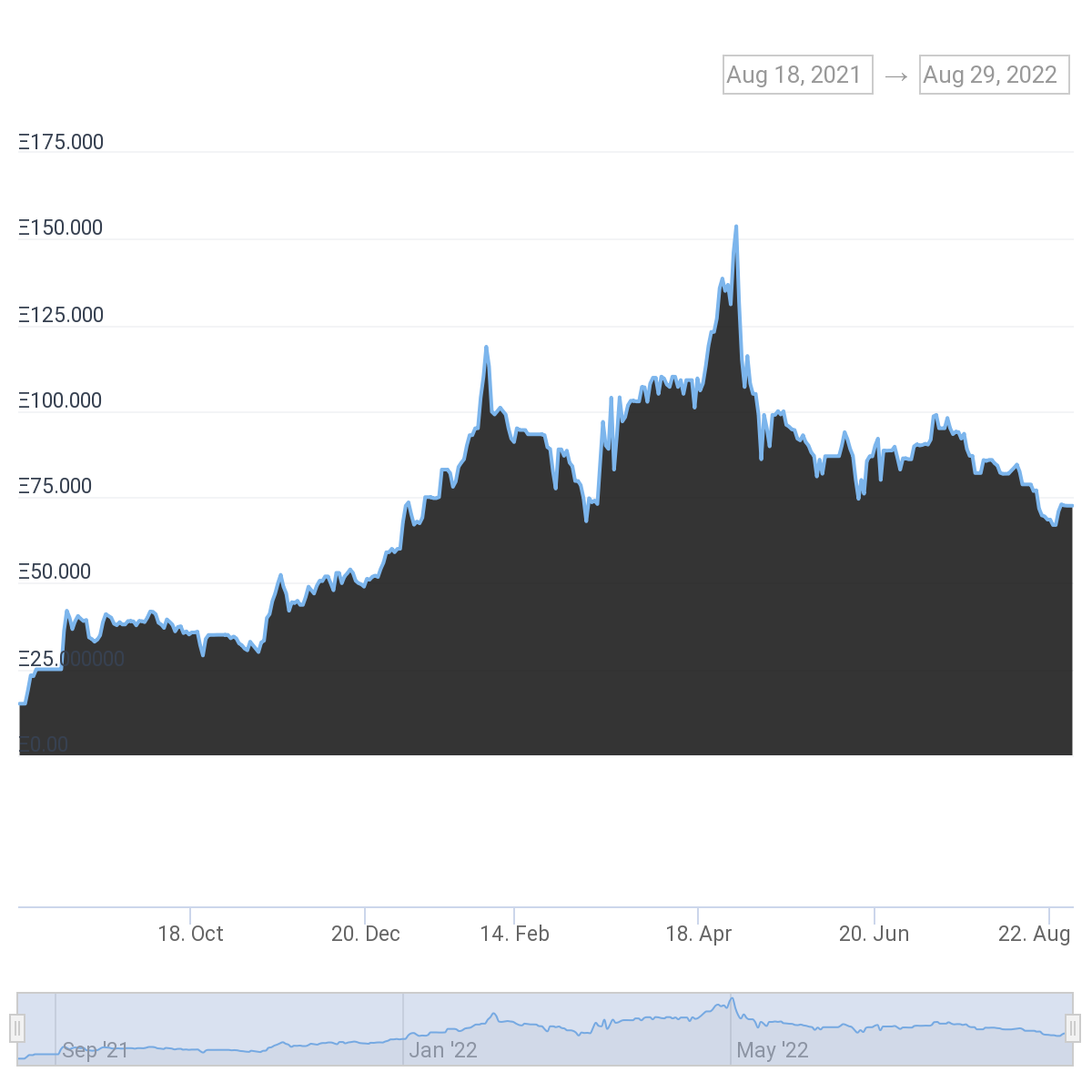

Leading digital collectible projects' declining floor pricing, or the lowest amount one is willing to pay for an NFT, serve as further evidence of this.

For instance, the floor price of the Bored Ape Yacht Club, which peaked at 153.7 ETH on May 1, has decreased by 53% to 72.5 ETH as of August 28.

Similarly, the floor price of CryptoPunks, another top NFT collection, dropped almost 20% from its July high of 83.72 ETH.

NFT bubble is bursting

The native currency of the blockchain on which NFTs are launched is used to quote their prices. Therefore, Ether (ETH) will be used to pay for a digital collectible made on Ethereum, which also indicates that NFT's prices will decrease if ETH's market value declines.

The weak NFT numbers appear to be mostly caused by a negative ETH market. The cost of one Ether has substantially decreased, going from $4,950 in November 2021 to under $1,500 in August 2022.

BendDAO votes to improve NFT liquidity

The decentralized autonomous organization BendDAO, which allows NFT owners to pledge their digital collectibles as collateral for loans (in ETH) amounting to 30%–40% of the NFT's floor price, decided last week to change the code of its protocol to make its NFT collateral more liquid.

The vote took place after a spike in the price of ether boosted the dollar worth of loans in ETH. On the other hand, the value of the collateral held by BendDAO decreased as a result of the sharp decline in NFT values.

Due to plummeting ETH prices, borrowers are unable to repay their dollar-denominated loans, and lenders are having trouble recouping their loaned money as a result of declining collateral values. As a result, BendDAO is currently experiencing its own debt crisis.

With the most recent vote, BendDAO reduced the requirement for NFT liquidation from 95% to 70%. In an effort to generate greater interest in the NFT collaterals, it has also cut the amount of time given to borrowers to prevent liquidation from 48 to 4 hours.

In other words, if market liquidity continues to decline, the floor price of NFTs, including BAYC, could further decline.

agreed, 2020-2021 was crazy get-rich-in-months & the DeFi-NFT-Web3 bubble is going bust now, turns out founders & VCs were scammers only in for the $$$.

— doncrypto (@DonCryptoDraper) August 29, 2022

But pipl said its over in 2018 too after ICOs.

The next bubble will come 100%, you just need to survive.

play the long game. https://t.co/5f17JfdFfY