Polkadot Price Prediction 2025-2030: Will DOT ultimately reach $200 in 2030?

Kim Dotcom Says 'US Is Beyond Bankrupt,' predicts that global markets will be destroyed in a controlled way

Polkadot Price Forecast: Do Not Defy The Fed

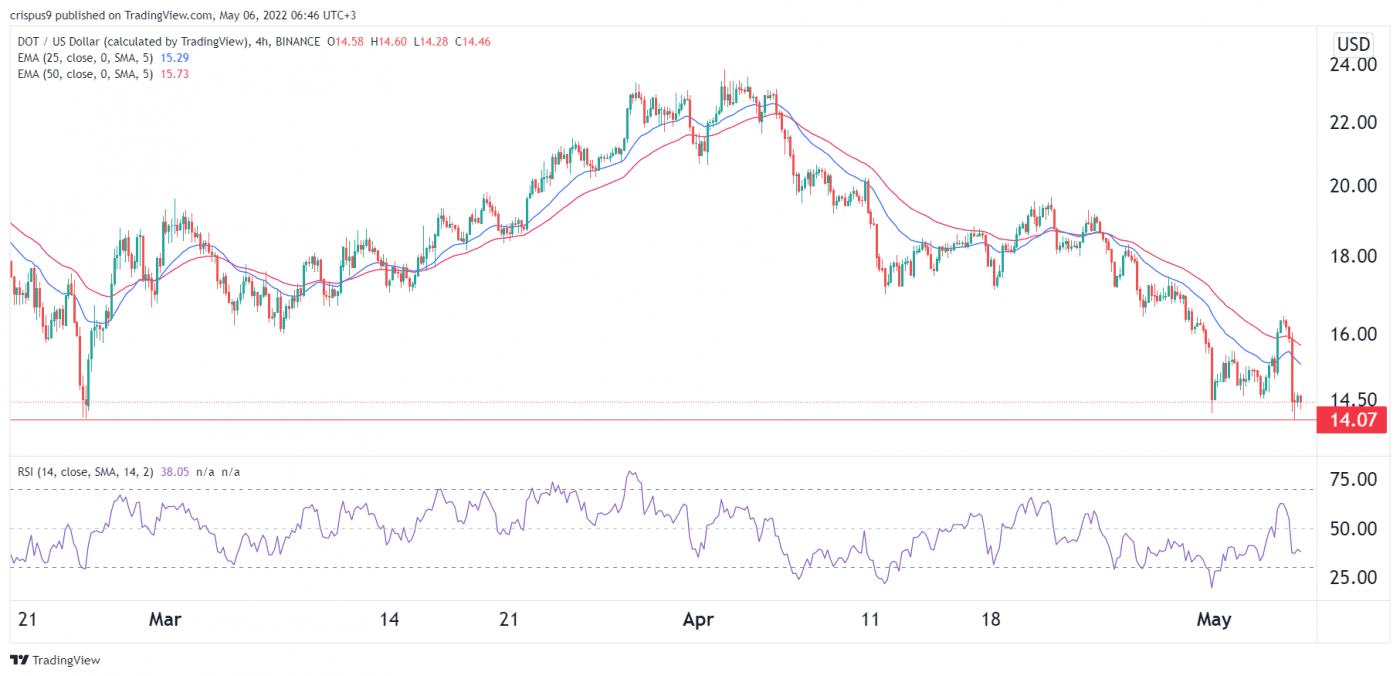

DOT dropped to a low of $14.45, its lowest price since February 2022. It has lost more than 40% of its value since the beginning of the year, bringing its entire market capitalization to around $16 billion. Other cryptocurrencies, such as Bitcoin and Ethereum, have also experienced a decline.

Polkadot is one of the world's largest cryptocurrencies. It is a blockchain-based project that enables developers to create parachain-based applications. Moonbeam and Acala Network are two examples of these parachains. These currencies increased in value this week following Polkadot's implementation of the XCM standard, which enables parachains to communicate with one another.

Polkadot's price fell sharply on Thursday as investors fretted about the Federal Reserve. When the Fed made its decision, it increased interest rates by 0.50 percent, the largest increase since 2000. Additionally, it signaled that it will begin executing a quantitative tightening strategy, which would imply a reduction in its balance sheet. The loss paralleled the Dow Jones and Nasdaq 100 indices, which both fell more than 5%.

Polkadot price forecast.

On the four-hour chart, we can see that DOT has fallen to a low of $14. A deeper examination reveals that this was the same pricing as on February 24th. It has deviated from the 25- and 50-day moving averages, while the Relative Strength Index (RSI) has gone below the neutral level of 50. Additionally, the price is below the dots of the Parabolic SAR.

As a result, the coin is likely to continue sliding as bears seek the next critical support level at $10. As long as the price remains below the 50-day moving average, this bearish trend will continue. Additionally, it is consistent with the language advising investors to sell in May and flee, rather than battle the Fed.